Solana (SOL) has hit a wall at the $200 resistance level, failing to break through last week. However, a crucial shift happening under the hood could be setting the stage for its next major move. The behavior of SOL investors is maturing, and this might be the key to its recovery.

A Surge in Long-Term Belief

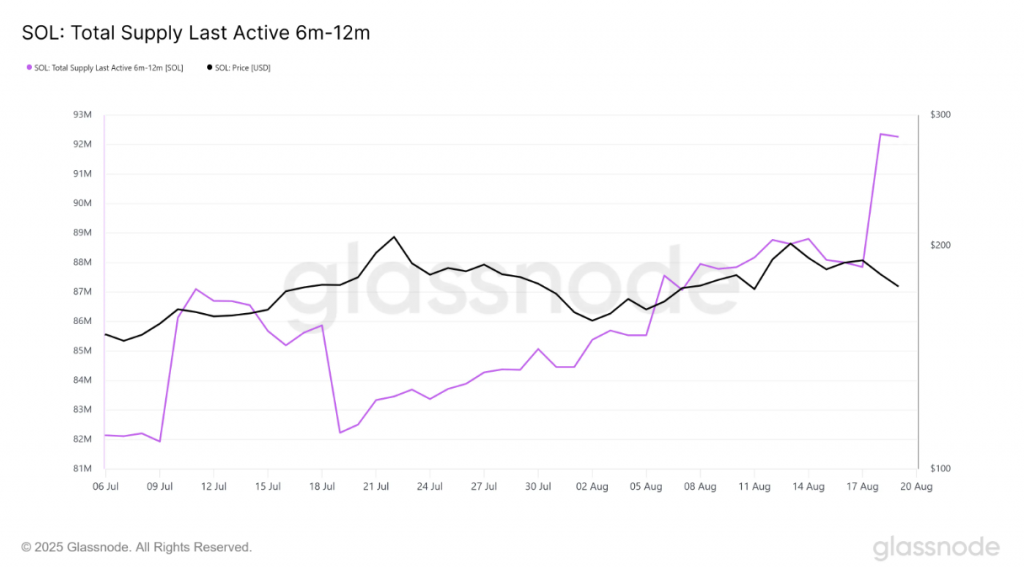

New on-chain data reveals a powerful trend: long-term conviction. In just the last 24 hours, a staggering 5 million SOL (worth over $905 million) that had been dormant for 6-12 months suddenly became active. This doesn’t mean it was sold—it means these holdings officially “matured” and transitioned into the long-term holder (LTH) category.

Why is this so important?

- Reduced Selling Pressure: Long-term holders are far less likely to sell on minor price dips.

- Increased Scarcity: It effectively locks up a large portion of the circulating supply.

- Bullish Signal: It demonstrates growing investor confidence in Solana’s future potential.

This maturation could create the solid foundation SOL needs to finally push past its key resistance levels.

The Short-Term Challenge

Despite this positive long-term signal, Solana faces a short-term headwind. The Chaikin Money Flow (CMF) indicator is currently negative, sitting below the zero line. This technical indicator suggests that capital is flowing out of SOL faster than it’s flowing in.

This selling pressure is the main reason SOL has struggled to reclaim $200. If outflows continue, it could keep the price suppressed in the near term.

Solana Price Prediction: Key Levels to Watch

So, where does SOL go from its current price of $180?

Bullish Scenario:

For a rally to begin, SOL must firmly hold above the $175 support level. If long-term holders continue to hold strong, Solana could rebound to reclaim $189. A successful break above that would set its sights back on the crucial $200-$201 resistance zone.

Bearish Scenario:

If selling pressure overwhelms the market and SOL breaks below $175, the next major support level sits at $163. A drop to this level would invalidate the current bullish outlook and likely lead to a deeper correction.

The path forward hinges entirely on whether long-term holder conviction can outweigh the current wave of selling.