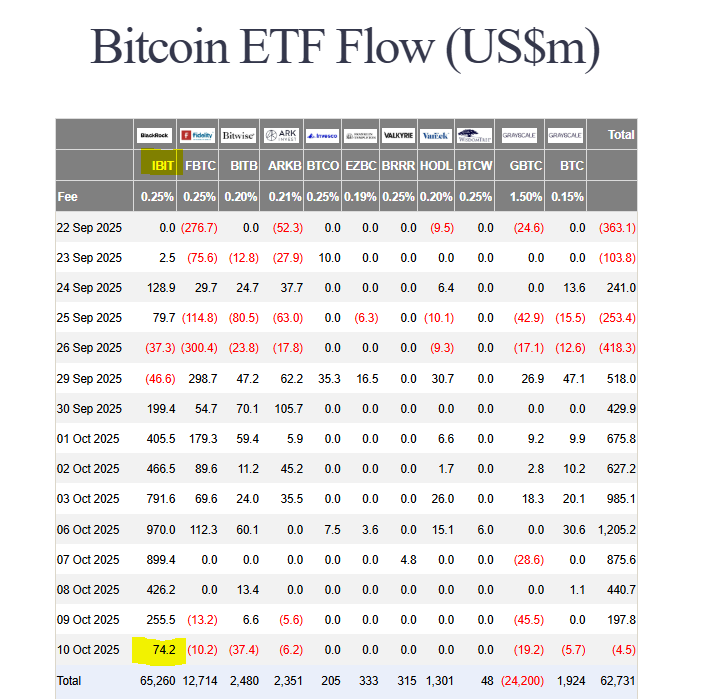

A key bullish streak has finally broken. Indeed, Bitcoin ETF outflows totaled $4.5 million on October 10, ending a historic nine-day run of positive flows. This reversal directly coincided with a sharp 8% price correction that saw Bitcoin tumble from $122,000 to a low of $105,000. Consequently, this suggests that institutional investors engaged in profit-taking after the massive rally.

Bitcoin ETF outflows Reaction to Price Dip

The data reveals a mixed picture beneath the surface. Remarkably, BlackRock’s IBIT ETF stood strong, attracting $74.21 million in inflows despite the market-wide sell-off. However, several other major funds faced redemptions. Specifically, Bitwise’s BITB saw the largest single-day outflow at $37.45 million. Meanwhile, Fidelity’s FBTC and Grayscale’s GBTC also experienced modest outflows.

This shift in sentiment follows an incredible inflow period that began on October 1. During those nine days, the products accumulated over $5 billion. Furthermore, the streak included two massive single-day inflows exceeding $1.2 billion and $875 million. Therefore, a brief cooldown was arguably overdue from a technical perspective.

Market Context and Future Outlook

Despite this single day of Bitcoin ETF outflows, the broader picture remains intensely bullish. Cumulative net inflows still stand at a massive $62.77 billion. Additionally, total assets under management are holding firm near $159 billion. Bitcoin’s quick recovery from $105,000 to above $111,700 also indicates strong underlying demand.

The price decline likely triggered stop-losses and profit-taking from short-term traders. However, long-term holders appear to be using this dip as a buying opportunity. The fact that BlackRock’s fund continued to see inflows is a particularly strong bullish signal.

My Thoughts

This is likely a healthy consolidation, not a trend reversal. All bull markets need breathers, and the ETF flow narrative remains overwhelmingly positive. The critical factor to watch is whether inflows resume next week. If they do, this brief outflow will be remembered as a minor blip in a much larger uptrend.