The mood shifted quickly in crypto markets. After a promising rebound, ETF outflows have returned. This reversal signals that institutional confidence remains fragile.

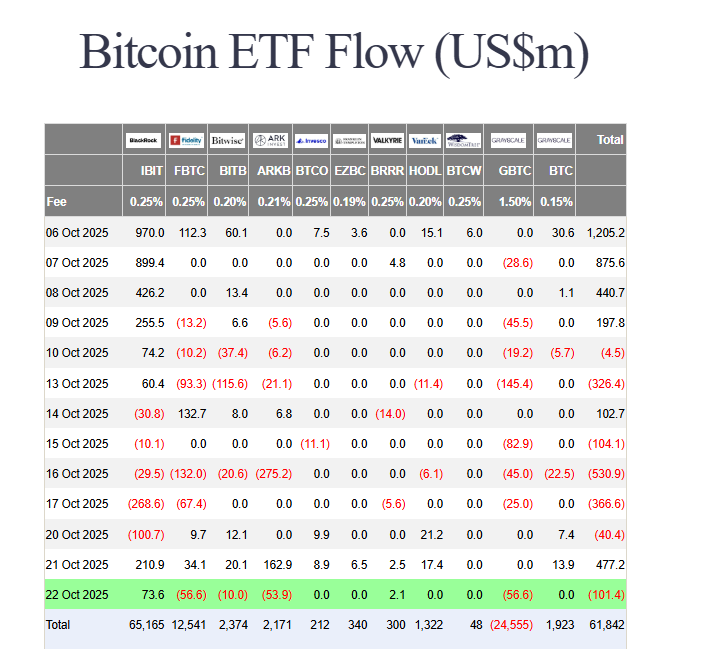

Bitcoin ETF Outflows

On October 22, spot Bitcoin ETFs saw $101.3 million leave the funds. This completely erased the previous day’s $477 million inflow.

The data reveals a divided picture. BlackRock’s IBIT stood strong with $73.6 million in inflows. However, this positive move was overwhelmed by withdrawals from other major funds. Fidelity’s FBTC and Grayscale’s GBTC both saw around $56 million in redemptions. Consequently, the overall trend turned negative.

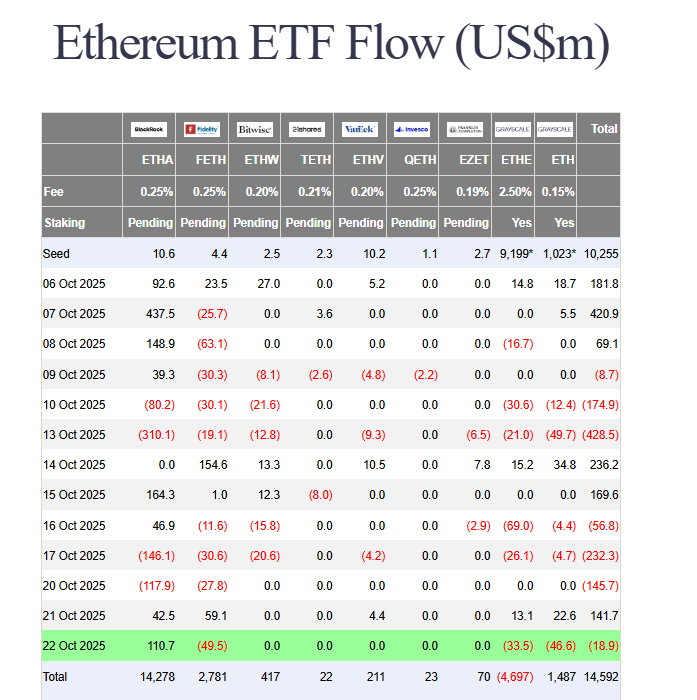

Ethereum Follows the Same Pattern

The story was similar for Ethereum ETFs. They recorded $18.8 million in ETF outflows. This ended their own brief recovery from the day before. Once again, BlackRock was the lone winner. Its ETHA product attracted $110.7 million. However, Grayscale’s Ethereum funds faced $80 million in combined withdrawals.

This return of ETF outflows highlights a broader market issue. Demand appears shallow and easily shaken. Furthermore, trading volume across all funds dropped significantly. This indicates that investors are sitting on the sidelines, unsure of the next direction.

Prices Struggle for Momentum

The price action reflects this caution. Bitcoin is trading around $109,783, struggling to break out of a narrow range. It has formed a pattern of lower highs since early October. Therefore, it needs a decisive break above $112,000 to revive bullish momentum.

Ethereum faces the same challenge. It is stuck near $3,869, unable to hold above $3,900. Both assets lack the volume and conviction for a sustained recovery. The total crypto market cap remains below its recent peaks as a result.

My Thoughts on ETF Outflows

This is a classic “two-steps-forward, one-step-back” recovery. The brief inflows were encouraging, but the quick return of ETF outflows shows the market isn’t out of the woods yet. Institutions are clearly trading these ETFs tactically rather than buying and holding. The market needs a strong catalyst, like a dovish Fed or positive CPI data, to break this cycle of shallow rallies and swift profit-taking.