The crypto world just witnessed a monumental event. The Bitwise Solana ETF staking ETF to be exact (BSOL) has officially launched, and its debut was nothing short of spectacular. This is the first Solana staking ETF approved for trading in the U.S., and it’s already shattering expectations. Consequently, the launch signals a massive vote of confidence in the Solana ecosystem from institutional investors.

A Record-Breaking First Day

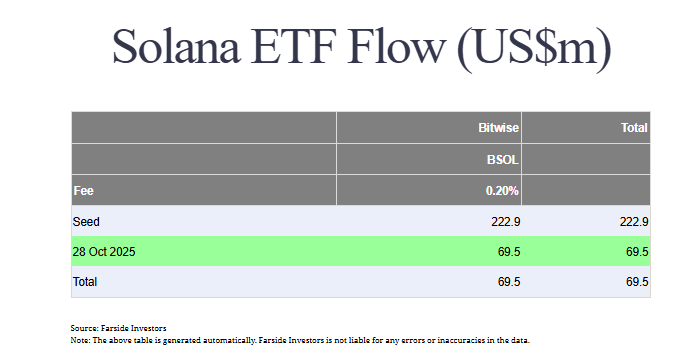

Let’s talk numbers, because they are staggering. On its first day of trading on NYSE Arca, the Bitwise Solana ETF recorded a massive $69.5 million in inflows. This figure absolutely dwarfs the previous offering, coming in nearly 480% higher. Moreover, the fund saw over $56 million in trading volume, making it the biggest crypto ETF launch since the spot Ethereum ETFs. Even Bloomberg’s senior ETF analyst Eric Balchunas called the $222.9 million in seed capital “impressive.” This explosive start provides clear, organic demand for Solana exposure.

What Bitwise Solana ETF Delivers to Investors

So, what exactly is the alpha here? The BSOL ETF provides a seamless way for investors to gain exposure to SOL. Even better, it stakes 100% of its assets. This clever strategy aims to generate over 7% in annual rewards for holders. Essentially, it combines price appreciation potential with a juicy yield—a powerful combo in any market condition.

SOL Price Action and Whale Watch

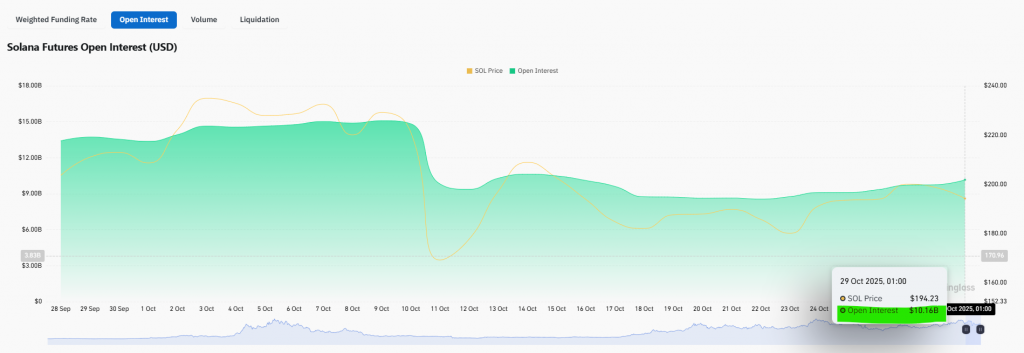

Interestingly, despite the euphoric ETF news, SOL’s price dipped slightly, trading around $194. However, don’t let that fool you. LookOnchain data reveals that crypto whales are actively accumulating and opening long positions. One whale with a perfect 100% win rate reportedly opened a 10x leveraged long on SOL. Meanwhile, derivatives data shows a healthy 3% climb in total futures open interest, surpassing $10 billion. This suggests strong underlying conviction from large players.

My Thoughts

This launch is a landmark moment for Solana. The massive inflows prove that institutional pathways are widening beyond just Bitcoin and Ethereum. While short-term price action can be volatile, the sheer scale of this ETF’s debut is an undeniable bullish signal for SOL’s long-term adoption and legitimacy.