Here’s a head-scratcher for you: Solana Price dip and it is currently trading at $175, down over 5% in the past 24 hours and breaking a key psychological level at $180.

Solana Price Dip Defies Logic as ETFs Rake in $199M

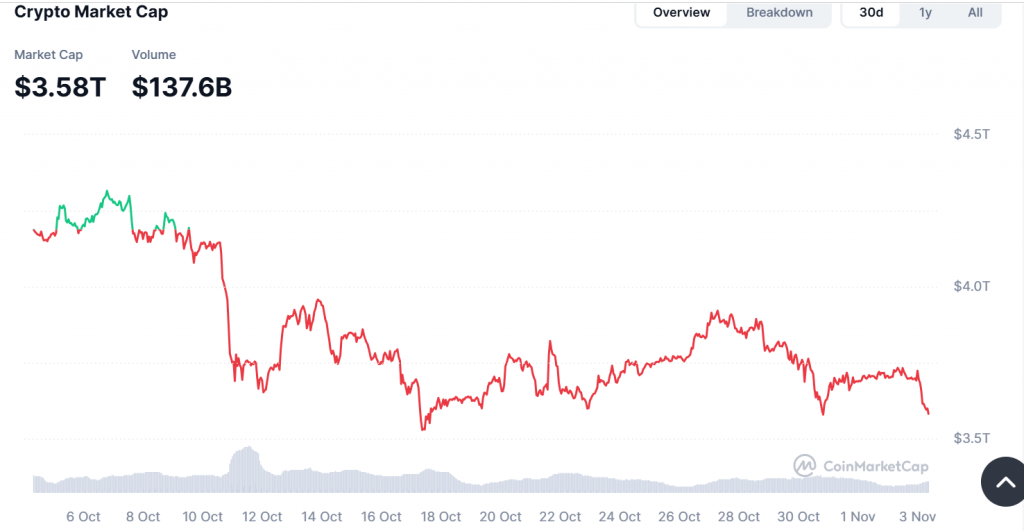

This Solana price dip is part of a brutal market-wide selloff that erased $114 billion in global market cap. But here’s the plot twist—while the price tanks, Solana’s spot ETFs are experiencing massive institutional demand, pulling in a staggering $199 million in inflows in their first week. This creates a fascinating divergence between weak price action and roaring institutional confidence.

Institutional Inflows Signal Long-Term Bullishness

Let’s talk about the elephant in the room: the ETFs. Products from issuers like Bitwise and Grayscale have already accumulated over $500 million in total assets. This isn’t small change; it’s a monumental vote of confidence from the smart money. These inflows indicate that institutions are using this market-wide weakness as a strategic accumulation zone. They’re playing the long game, looking past the short-term volatility toward Solana’s fundamental potential. So, while retail traders panic-sell, the big players are quietly building positions.

The Solana Price Dip Technical Crossroads: Key Support at $175

Technically, SOL is at a critical juncture. The asset is now approaching a major support zone around $175, a level that has held strong since early August. This is the line in the sand. If bulls defend this level aggressively, it could form a solid base for a reversal, with a reclaim of $200 being the first sign of a recovery. However, if this support cracks, the next stops are much lower—at $157 and potentially the October crash lows near $142. The RSI and other momentum indicators are leaning bearish, so the battle at $175 is crucial.

The Verdict: A Buying Opportunity or a Trap?

So, is this a bear trap or the start of a deeper correction? The data presents a conflicting picture. The relentless ETF inflows are a powerfully bullish fundamental counterweight to the weak technicals. This divergence often resolves with a violent move upward once the broader market stabilizes. For savvy investors, this Solana price dip could be a golden opportunity to “buy the rumor” of institutional adoption before the price catches up to the demand.

My Thoughts

This is a classic case of the market being inefficient in the short term. The ETF flows don’t lie—institutions are betting big on SOL. I believe this dip is a gift. The fundamentals are strengthening even as the price weakens, creating a prime setup for a powerful rebound once the overall crypto market finds its footing. Don’t let the red candles fool you; the big money is positioning for the next leg up.