The institutional exit is accelerating. Bitcoin ETF Outflows just recorded a devastating $186.5 million, marking the fourth consecutive day of bleeding. This brings the total capital flight to a staggering $1.34 billion since late October.

Bitcoiun ETF Outflows Source : SoSoValue

Blood in the Streets: Bitcoin ETF Outflows Signal Deepening Correction

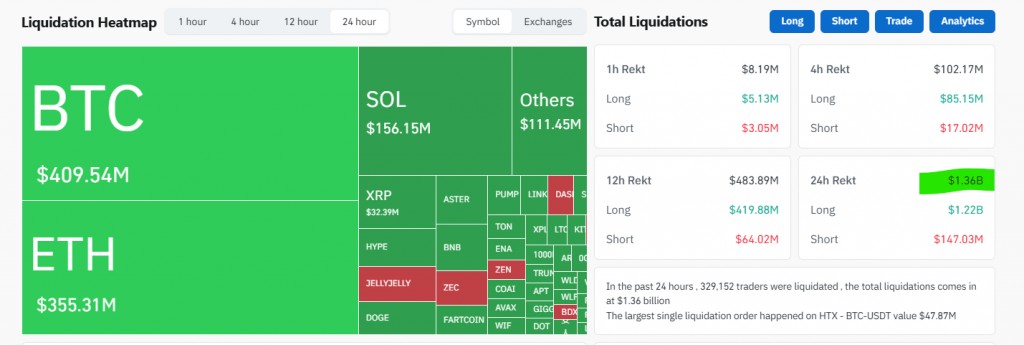

The consequence? Bitcoin price imploded to $103,701, down over 9% for the week and triggering a liquidation bloodbath. Over 336,000 traders were wiped out as $1.36 billion in leveraged positions vanished. This is a full-scale market cleanse, and the pain isn’t over yet.

The Great Divergence: Weak Hands Fold, Smart Money Accumulates

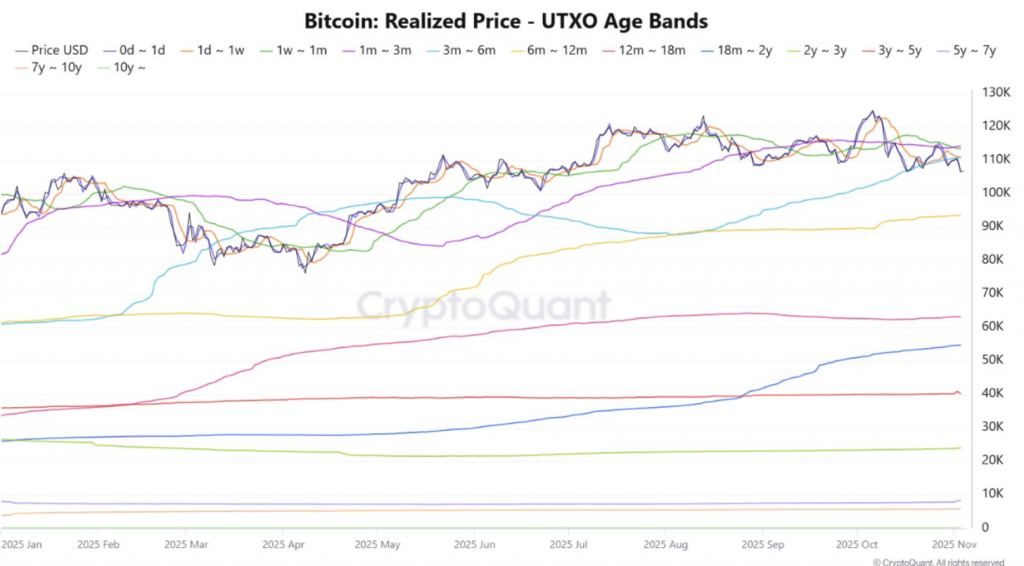

Here’s where the plot gets interesting. CryptoQuant reveals a clear split in market behavior. The Bitcoin ETF outflows and price drop are forcing short-term holders (those who bought 1-3 months ago) to panic sell. Their average cost basis is $107,160, meaning they are now selling at a loss. However, the “smart money”—investors in the 3-6 month cohort—has started to accumulate again. This is a classic sign that experienced players are viewing this dip as a buying opportunity. But caution remains; analysts note this accumulation is not yet aggressive, suggesting they are waiting for even lower prices or full capitulation from weak hands.

Critical Support Levels: The Line in the Sand at $102,000

All eyes are now on key technical supports. The most immediate level is the 50-week simple moving average (SMA) near $102,000. Bitcoin hasn’t tested this level in seven months, and a break below it could trigger a deeper psychological panic. The next major line of defense is the $93,561 level, which represents the average cost basis for the 6-12 month holder cohort. If long-term investors start to feel pain, the sell-off could intensify dramatically. For bulls, defending $102,000 is absolutely critical to prevent a full-blown correction.

The Path Forward: Capitulation Before Resurrection

While the short-term picture looks bleak, this is how healthy markets reset. The massive leverage flush and the Bitcoin ETF outflows are wiping the slate clean of excess. History shows that these violent corrections often create the foundation for the next powerful leg up. For the trend to reverse, we need to see two things: a slowdown in ETF outflows and Bitcoin reclaiming the $111,000 level. Until then, the momentum remains squarely with the bears.

My Thoughts

This is a necessary, if painful, reset. The market was over-leveraged and needed this flush. The smart money accumulation is the first green shoot of recovery. I’m treating this as a potential final capitulation before the next leg up in the bull market. For those with dry powder, scaling into positions between $102K-$105K could be a strategic move with a long-term horizon.