Despite continued pressure on major crypto ETFs, Altcoin ETFs inflows remained in the green on November 4th, showing strong resilience in a weak market.

While both Bitcoin ETFs and Ethereum ETFs faced their fifth consecutive day of outflows — totaling $577 million and $219 million respectively — Solana, HBAR, and Litecoin ETFs continued to attract positive inflows, even as their underlying prices dropped.

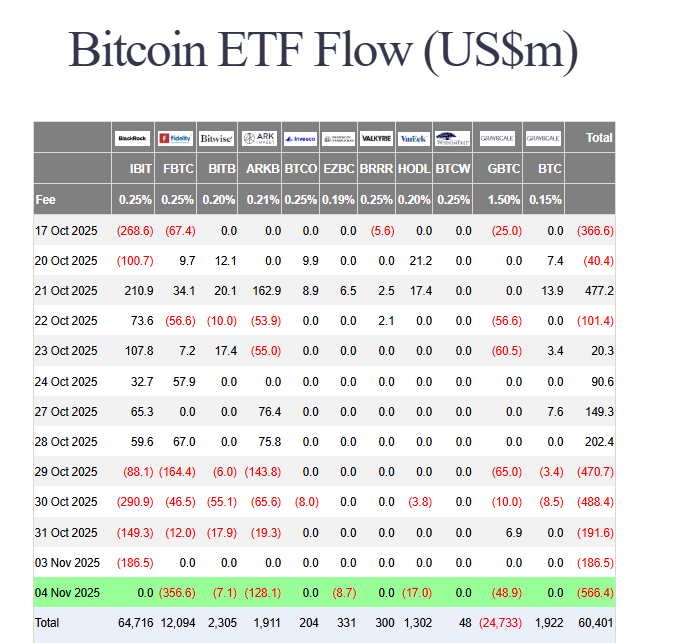

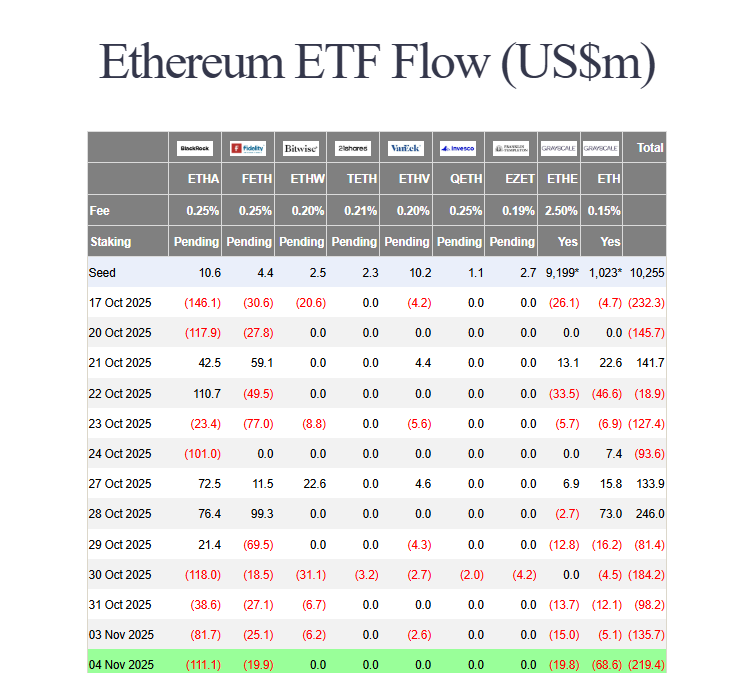

Market Context: Bitcoin and Ethereum ETFs Extend Outflows

The crypto market remains under stress, as institutional sentiment toward the top two digital assets continues to cool.

Bitcoin ETFs posted their largest two-month outflow — $577 million on November 4th — while Ethereum ETFs lost $219 million on the same day.

Yet, amid the heavy red across the charts, Altcoin ETFs inflows paint a much more optimistic picture, suggesting investors are quietly rotating capital toward promising blockchain ecosystems beyond Bitcoin and Ethereum.

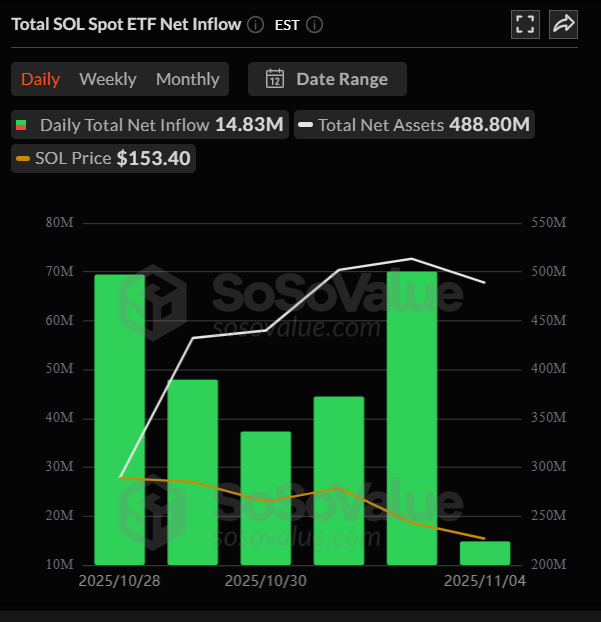

Solana ETF Records Fifth Consecutive Inflow

The Solana ETF continued its positive streak with a net inflow of $14.83 million on November 4th — the smallest since its launch, but still firmly in positive territory.

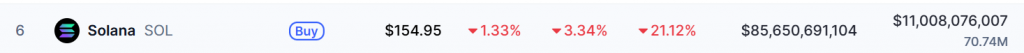

Even as $SOL fell to $155, marking a 20% weekly drop, the consistent institutional interest shows confidence in Solana’s long-term fundamentals and network growth.

Since launch, the Solana ETF has now logged multiple consecutive days of net inflows, underscoring that institutional investors see recent market dips as potential accumulation opportunities.

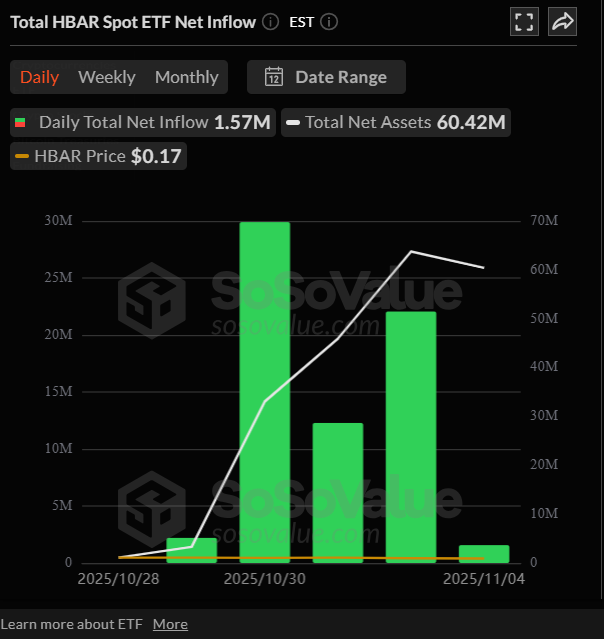

HBAR ETF Maintains Positive Momentum

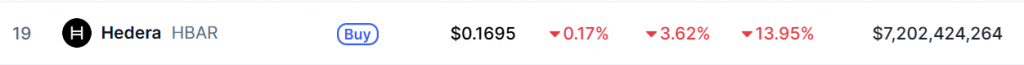

The HBAR ETF also posted its fifth consecutive day of inflows, bringing in $1.57 million on November 4th.

While it’s the ETF’s lowest daily inflow since launch, it remains significant considering HBAR’s 14% weekly decline, now trading at $0.1690.

The steady inflows suggest that institutional participants continue to support Hedera’s enterprise-focused blockchain ecosystem, even during broader market pullbacks.

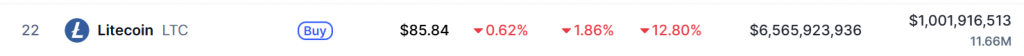

Litecoin ETF Sees Small but Steady Inflows

The Litecoin ETF saw another day of positive movement, recording $202,650 in inflows on November 4th, keeping its streak alive despite market turbulence.

With $LTC down 13% this week and currently trading at $85.47, the fund’s consistent though modest growth signals slow but stable institutional demand.

Altcoin ETFs Inflows Highlight Shifting Institutional Focus

The persistence of Altcoin ETFs inflows — even as flagship assets face heavy outflows — may point to a quiet shift in institutional strategy.

While risk sentiment remains fragile, large investors appear increasingly open to diversifying beyond Bitcoin and Ethereum.

Solana, HBAR, and Litecoin ETFs holding positive ground in a red market reinforces the idea that the next wave of institutional crypto exposure could come from the altcoin segment.

Conclusion: Resilience in the Face of Red

In a market marked by fear, liquidations, and outflows from major ETFs, Altcoin ETFs inflows stand out as a sign of resilience.

Solana, HBAR, and Litecoin ETFs continue to attract capital — even as their prices fall — showing that smart money may be positioning for the next phase of the crypto cycle.