While weak hands panic-sell, the smart money is executing the greatest accumulation campaign of this cycle. Stunning new data from CryptoQuant reveals that Bitcoin accumulation addresses have skyrocketed by 101% in just two months, exploding from 130,000 to 262,000.

Smart Money Goes All-In: Bitcoin Accumulation Addresses Explode 101%

Even more breathtaking, these diamond-handed entities added a colossal 50,000 BTC in a single day on November 5th. This isn’t just buying the dip; this is a systematic, large-scale acquisition program that signals unshakable long-term conviction, completely disregarding the current price fear and ETF outflows.

Who Are These Mystery Accumulators?

So, what exactly is an accumulation address? These are no ordinary wallets. According to CryptoQuant’s definition, these entities have several key traits: they’ve been active within the last 7 years, they are not known exchanges or miners, and they are not smart contracts. Most importantly, they almost exclusively buy and never sell. Their behavior is the purest form of “HODLing.” The 30-day net accumulation from these addresses has hit a record 375,000 BTC, smashing previous all-time highs. This is the institutional and whale-class capital that builds the foundation for the next parabolic move.

The Great Divergence: Accumulation vs. ETF Outflows

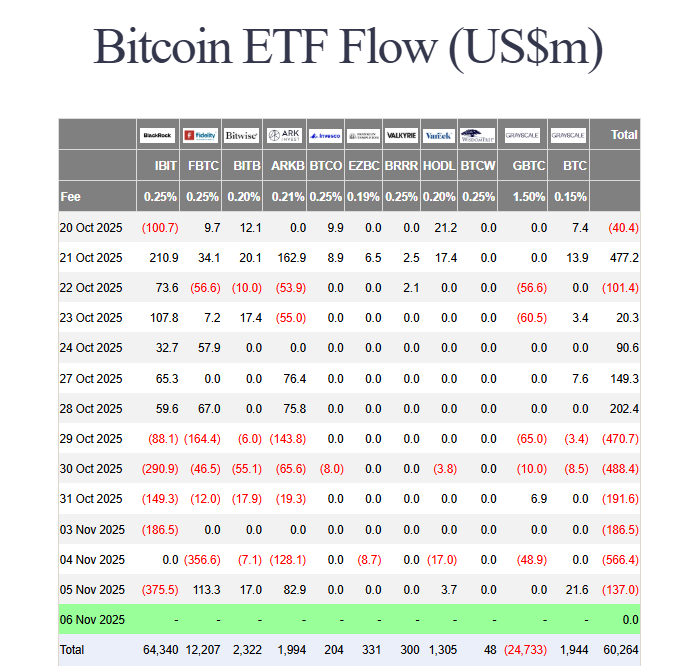

Here’s the fascinating paradox that creates a massive opportunity. While these Bitcoin accumulation addresses are hoarding coins at a record pace, the spot Bitcoin ETF market is experiencing significant outflows, with $186.5 million leaving on November 4th alone. This tells a story of two different markets: the short-term, reactive ETF traders who are selling, and the long-term, strategic accumulators who are buying everything they’re selling. This is a classic sign of a market bottom formation. When weak, price-sensitive paper hands transfer their coins to strong, value-focused diamond hands, it sets the stage for a violent upside move.

What This Means for the Bitcoin Price Bottom

This data is a powerfully bullish counter-narrative to the prevailing fear. The price may be struggling around $102,000, but the underlying ownership structure is becoming stronger than ever. The growth of these Bitcoin accumulation addresses is likely being accelerated by the very existence of ETFs, which provide a liquid market for large players to source coins without drastically moving the price. For investors, the message is clear: the entities with the strongest conviction are using this dip to load up. When the trend reverses, the resulting supply shock could be explosive.

My Thoughts

This is the most bullish on-chain data I’ve seen all year. It confirms that the fundamental health of the Bitcoin network is incredibly strong, even while the price action is weak. This is exactly the kind of stealth accumulation that happens before a massive rally. I believe we are witnessing the formation of a generational bottom. Once the ETF outflows subside, the combination of limited supply and this raging demand will launch Bitcoin to new heights.