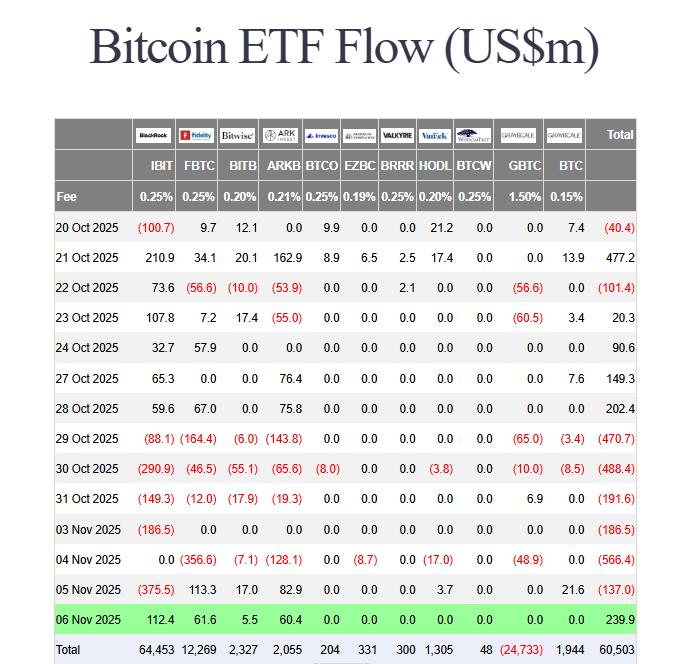

The bleeding has finally stopped! In a major psychological victory for bulls, spot Bitcoin ETFs snapped a brutal six-day outflow streak, recording a solid $240 million in net Bitcoin ETF inflows on November 6th.

Bitcoin ETF Inflows Return in Bullish Reversal as $100K Holds Firm

This crucial reversal helped Bitcoin fiercely defend the critical $100,000 support level after a punishing 16% weekly decline. The positive flow was mirrored in Ethereum ETFs, which also saw their first inflows in nearly a week. While the Fear and Greed Index remains deep in “Extreme Fear” at 21, this shift in ETF momentum could be the first sign that institutional buyers are finally stepping back in.

Not Out of the Woods Yet: Key Capitiation Metrics Still Missing

Despite the welcome ETF news, on-chain data suggests we may not have seen a true market bottom yet. Analytics from CryptoQuant reveal that exchange reserves on Binance are still rising, indicating traders continue to deposit BTC—a common precursor to selling. Furthermore, the Coinbase Premium Index remains negative, showing a lack of aggressive buying from U.S. investors that typically marks a durable low. The Short-Term Holder Realized Profit Ratio also hasn’t reached the extreme panic levels seen at past bottoms. This means that while the Bitcoin ETF inflows are a positive start, sustained buying is needed to confirm a trend reversal.

The Silent Accumulation by Long-Term Holders

Here’s the hidden bullish narrative: while short-term traders panic, long-term holders are quietly accumulating. The realized price for these “permanent holders”—wallets that have never sold—has climbed to $78,520. This group, believed to be institutions and whales, is effectively absorbing all the selling pressure from weak hands. As long as Bitcoin stays above this key $78.5K cost basis, a full-scale “crypto winter” remains unlikely. This creates a powerful underlying support zone that could launch the next leg up once sentiment improves.

Technical Outlook: The Battle for $100,000 and Beyond

Technically, the battle lines are clearly drawn. Bitcoin is currently clinging to the $101,000 level, with immediate resistance looming between $103,000 and $108,000. The RSI at 35 indicates the asset is oversold, and the MACD is hinting at a potential bullish convergence. If bulls can defend $100,000 and capitalize on the returning Bitcoin ETF inflows, a relief rally toward $108,000 or even $115,000 is possible. However, a breakdown below the psychological $100,000 level could trigger a swift move down to test the $95,000 support.

My Thoughts

This is a critical inflection point. The return of ETF inflows is the first step to restoring confidence, but the market needs to see follow-through. I’m watching the Coinbase Premium closely for a return to positive territory, which would signal that U.S. buyers are back in force. The long-term holder accumulation is the most bullish data point; it tells me smart money is positioning for the next cycle high. I’m cautiously optimistic that we’ve found a near-term bottom.