The Avalanche price has been crushed, plummeting to a precarious $16.70 from its October high of $36. This brutal drop mirrors the broader market meltdown, but AVAX is now trading at a critical support level where the tide may be turning.

Avalanche Price Prediction: Is the Bottom In? Key Rebound Signals Flash

Despite the gloomy price action, our Avalanche price prediction is turning cautiously optimistic. Why? Because two massively bullish fundamental catalysts—the upcoming Granite upgrade and a record-breaking token burn rate—are colliding with an oversold technical setup, creating a potential powder keg for a powerful rebound.

Fundamental Firepower: The Granite Upgrade and Soaring Burn Rate

Let’s talk about the engines that could drive this recovery. First, the Granite upgrade, set to activate on November 19, is one of the most significant network improvements since Avalanche’s launch. It will introduce cutting-edge features like biometric secure identity verification and faster transactions. Historically, major upgrades like this act as powerful price catalysts. Second, and perhaps more importantly, the network’s fee burn mechanism is going parabolic. The amount of AVAX burned in October hit its highest level since March of last year, with nearly 5 million tokens permanently removed from circulation. This creates deflationary pressure that directly counters sell-side inflation.

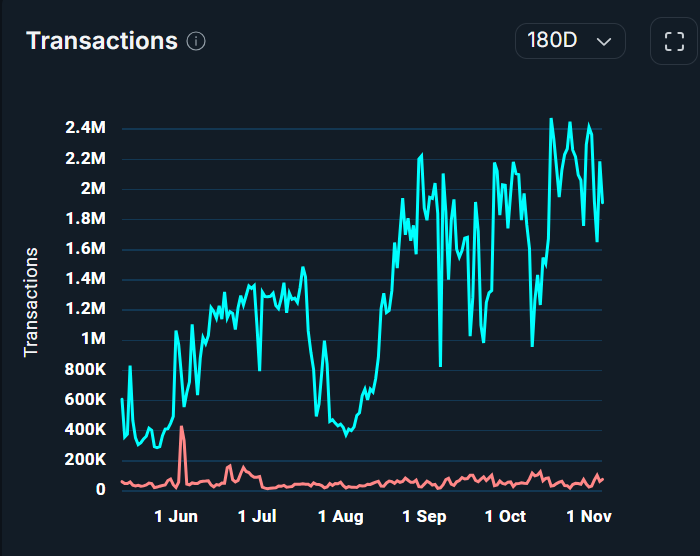

Network Activity Defies the Price Slump

The underlying health of the Avalanche network tells a completely different story from its price chart. Data from Nansen shows transactions surged 50% in the last 30 days to 58.1 million, generating $1.6 million in fees. Even more impressive, Avalanche is dominating the Real-World Asset (RWA) tokenization space, handling over 66% of the sector’s volume—a staggering $1.2 billion in the last month. This proves that developer and institutional activity remains fiercely strong, making the current price look severely disconnected from fundamental value.

Avalanche Price Prediction: Technicals Point to a 115% Rally

The charts are now hinting at a major reversal. The daily chart shows AVAX has formed a potential triple bottom pattern around the $15.50 support level. This is a classic reversal formation. The pattern’s neckline sits near $36, which would represent a 115% rally from current levels. While that may seem ambitious, the RSI and MACD oscillators are showing early signs of bullish convergence, suggesting selling momentum is exhausting. A more immediate and conservative Avalanche price prediction would target a rebound to the $26.62 resistance level. The line in the sand for bulls is clear: the pattern is invalidated if $15 support breaks.