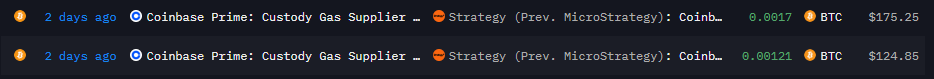

The king of corporate Bitcoin is back, and he’s loading up the cannon. On-chain data reveals that Michael Saylor’s Strategy has executed five separate test transactions from Coinance Prime over the last two days. In the world of institutional crypto, this is the clearest possible signal that a major Bitcoin accumulation is being prepared.

Strategy Bitcoin Accumulation Alert: Test Transactions Signal Major Buy

These small test sends are standard procedure for whales and corporations to ensure their wallet infrastructure is flawless before executing a multi-million dollar purchase. For a firm of Strategy’s caliber, this almost certainly means a massive buy order is imminent.

Another Signal, Yesterday Saylor Makes Bold Bitcoin Buy Call, the outspoken message of Buy Now by Saylor brought back bullish hopes.

The Fuel for the Fire: A $717 Million War Chest

This isn’t just speculation; Strategy has the dry powder ready to deploy. The test transactions come hot on the heels of a massive €620 million (roughly $717 million) fundraise via a European security offering. This marks the first time the company has tapped foreign markets since its 1998 IPO, demonstrating a global investor appetite for its Bitcoin-centric strategy. With this capital now secured, the market is bracing for what could be one of Strategy’s largest single Bitcoin accumulation moves yet, further cementing its 641,205 BTC treasury.

A Tale of Two Whales: Saylor Buys, OG Whale Sells

In a dramatic market dichotomy, Strategy’s planned accumulation comes as a longtime Bitcoin OG whale, Owen Gunden, is aggressively exiting his position. Since October 21, Gunden has been dumping his massive stash via Kraken, recently sending his last 3,549 BTC (worth $361 million) to an unknown address, which has already deposited 600 BTC to the exchange. This creates a fascinating battle: the systematic, institutional Bitcoin accumulation from Saylor versus the distribution from a veteran holder. The buying pressure from Strategy will need to be substantial to absorb this selling overhang.

Market Impact: A Clash of Titans

This sets up a critical moment for Bitcoin’s price, currently trading around $101,800. The selling from a single large whale can create significant downward pressure. However, the announcement of a major purchase from Strategy—a proven positive catalyst—has the power to completely shift market sentiment and neutralize the selling. It’s a classic battle between old and new money, and the outcome will likely determine Bitcoin’s short-term direction.

My Thoughts

This is institutional conviction in its purest form. While a weak-handed whale capitulates, Saylor is demonstrating the power of a long-term, corporate treasury strategy. I believe the psychological impact of a new Strategy buy will far outweigh the selling pressure. It reminds the entire market that there is a multi-billion dollar bid waiting for any dip. This is profoundly bullish for sentiment and could be the catalyst that ends the current correction.