The privacy coin is putting on an absolute masterclass in outperformance. While Bitcoin and Ethereum bled to multi-month lows, Zcash staged a stunning Zcash price surge, rocketing nearly 90% in the first eight days of November.

Zcash Price Surge Defies Gravity with 90% November Rally

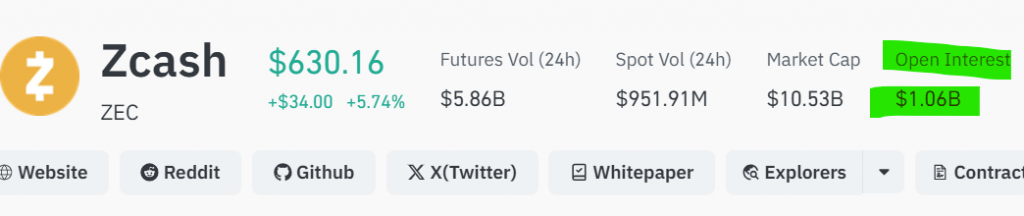

After a brief 4% pullback, ZEC has steadied around $630, demonstrating remarkable resilience. But the real story is happening in the derivatives market, where Open Interest has exploded past $1 billion. This massive capital influx signals that traders are placing huge bets on ZEC’s next move, creating a tense standoff between bulls and bears.

The $1 Billion Battle: Bulls and Bears Clash in Zcash Futures

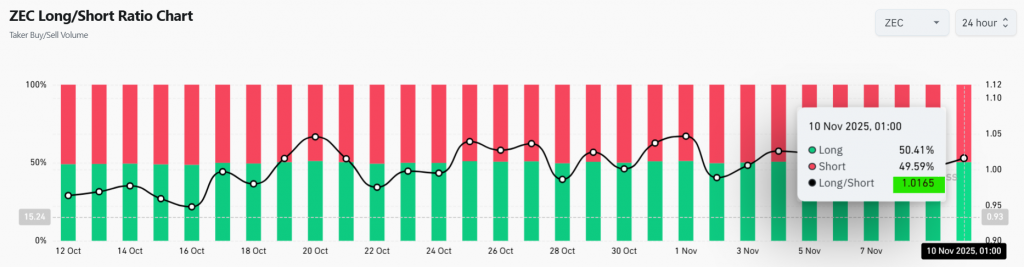

The derivatives data reveals an incredibly balanced and tense battlefield. While Open Interest grew by $14 million, the long/short ratio is sitting at a perfectly neutral 1.016. This means that every dollar bet on the Zcash price surge continuing is matched by a dollar betting on a deeper correction. This equilibrium shows that the market is at a critical inflection point. Traders are essentially waiting for the next major catalyst—be it a macro signal or a shift in privacy coin sentiment—to decide the next directional move. The sheer volume of capital involved means the resulting breakout or breakdown could be violent.

Technical Checkup: Is the Zcash Price Surge Exhausted?

The technical picture offers clues for both bulls and bears. On the bullish side, the MACD remains in positive territory, confirming the underlying uptrend is still intact. However, the flattening histogram and an overbought Money Flow Index (MFI) reading of 71.17 suggest the momentum from the initial Zcash price surge is slowing. ZEC is currently trading just below key resistance at the $667 upper Bollinger Band. A decisive daily close above this level would be a strong technical confirmation that the rally is resuming, with a clear path toward $750 and even $820.

Key Levels to Watch: The Bull and Bear Scenarios

For traders, the lines are clearly drawn. The bullish case hinges on defending the $580-$560 support zone, which aligns with the middle Bollinger Band. If this level holds as a new launchpad, the odds of a fresh leg higher increase dramatically. Conversely, the bearish scenario triggers if this support band breaks. A drop below $560 would likely trigger a deeper retracement toward the $500 level, which would represent a healthy but painful correction after such a parabolic advance.

My Thoughts

This is a textbook case of a strong asset taking a well-deserved breather. The Zcash price surge was massive and needed to consolidate. The neutral derivatives positioning is actually bullish—it shows that despite a 90% run, there isn’t excessive leverage or FOMO, which makes the rally healthier. I believe the path of least resistance is still up, especially if the broader market stabilizes. The privacy narrative is stronger than ever, and ZEC is its leading indicator.