The relentless accumulation continues! Michael Saylor’s Strategy has executed its latest Strategy Bitcoin purchase, adding 487 BTC to its corporate treasury at an average price of $102,557.

Strategy Bitcoin Purchase Continues Unstoppable with 487 BTC Acquisition

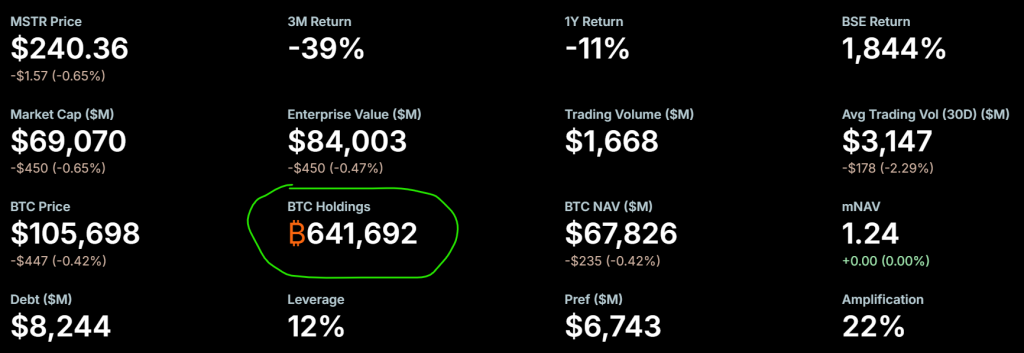

This $49.9 million acquisition, disclosed in an SEC filing, solidifies the firm’s unshakable conviction. The purchase was strategically funded through the sale of preferred stock, showcasing a sophisticated capital markets strategy that avoids diluting common shareholders. This brings Strategy’s legendary hoard to 641,692 BTC, cementing its status as the world’s largest corporate Bitcoin holder.

The Funding Masterstroke: Using Preferred Stock for Bitcoin Purchases

Here’s the financial engineering genius behind this Strategy Bitcoin purchase. The company didn’t tap into cash reserves or sell common stock. Instead, it utilized its “at-the-market” offering program, generating $50 million by selling four classes of preferred stock. This method is brilliant for two reasons: it provides immediate capital for Bitcoin acquisition, and it prevents the dilution of common shareholders’ value. This demonstrates a mature, repeatable model for corporate Bitcoin accumulation that other public companies can now emulate.

The Staggering Numbers: $20 Billion in Unrealized Gains

Let’s talk about the results of this relentless strategy. Strategy’s total investment in Bitcoin now stands at $47.54 billion, with an average buy-in price of $74,079 per coin. With Bitcoin trading around $105,700, the company’s holdings are worth a staggering $67.83 billion. That translates to an unrealized gain of over $20.29 billion—a monumental validation of Saylor’s “digital gold” thesis. Furthermore, the firm has achieved a 26.1% BTC yield year-to-date in 2025, dramatically outperforming most traditional assets.

A Bottomless War Chest for Future Bitcoin Purchases

Perhaps the most bullish takeaway is the dry powder still available. Strategy maintains over $26 billion in remaining capacity across its various stock offering programs. This means the Strategy Bitcoin purchase we just witnessed is merely a preview of what’s to come. The company has a virtually unlimited capacity to continue buying Bitcoin for the foreseeable future, creating a permanent, institutional-grade bid underneath the market.

My Thoughts

Saylor is playing chess while everyone else plays checkers. This Strategy Bitcoin purchase is another masterclass in corporate treasury management. The use of preferred stock is a sophisticated evolution of their strategy. The $20 billion gain isn’t just a number; it’s a beacon that guides every other public company toward Bitcoin. As long as Strategy continues to buy, the entire market has a foundational support level. They are not just a holder; they are a market-moving force.