Yesterday (Nov 13) saw one of the largest single-day withdrawals in the short history of spot Bitcoin ETFs: Bitcoin ETF outflows totaled $866.7 million, a major liquidity event that coincided with Bitcoin closing below $100,000 for the first time since May 6, 2025. The move rippled across crypto markets, driving widespread liquidations and steep losses in major altcoins.

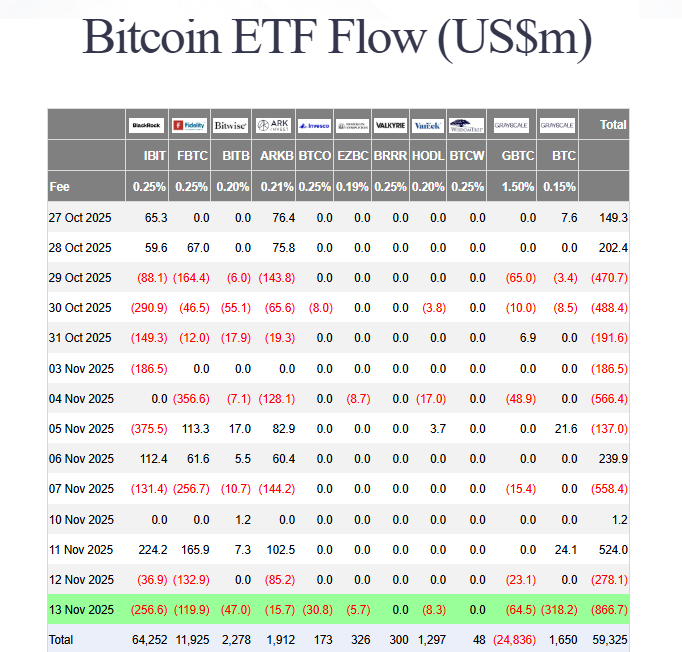

Biggest single-day redemptions: issuer breakdown

The Nov 13 outflow was concentrated among a few large issuers:

- Grayscale (BTC): –$318.2M

- BlackRock (IBIT): –$256.6M

- Fidelity (FBTC): –$119.9M

Together these three managers accounted for the lion’s share of the $866.7M daily outflow, highlighting how issuer-level reallocations can quickly overwhelm intraday liquidity and amplify price moves.

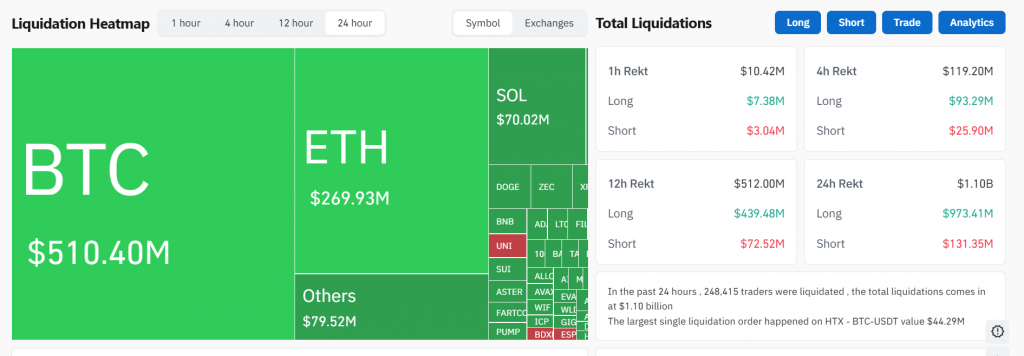

Price action and forced liquidations

The heavy Bitcoin ETF outflows coincided with a sharp price break: Bitcoin fell below $100K, closing the daily candle under that level — a key psychological and technical threshold. At the time of writing, BTC trades around $96,995. That breakdown triggered significant leverage unwind:

- Total crypto liquidations: ~$1.1 billion across the market.

- Longs liquidated: ~$973 million — showing that leveraged long positions bore the brunt of the squeeze.

Derivatives metrics and futures desks will be watching closely: sustained outflows combined with leverage liquidations can create feedback loops that deepen short-term volatility.

Market cap, altcoins and breadth of the sell-off

The broad market felt the pain: total crypto market capitalization fell more than 6%, now reading roughly $3.28 trillion on CoinMarketCap. Major altcoins posted heavy losses:

- Ethereum (ETH): –9.47%, trading near $3,199.

- XRP: ~–8%, trading around $2.28, despite a strong ETF debut earlier.

- Solana (SOL): >–9%, trading near $142, even as Solana ETFs continue to show net inflows since launch.

The sell-off reflects a combination of ETF redemptions, leveraged positioning, and short-term risk-off sentiment among both retail and institutional participants.

What this means for markets and traders

- Flows matter — Large concentrated ETF outflows can overwhelm liquidity and trigger meaningful price moves even when other indicators appear stable.

- Short-term risk is elevated — The near-term environment favors volatility; traders with leveraged long positions are particularly exposed.

- Watch for stabilization — Key signals to monitor: daily net ETF flows, futures open interest, funding rates, and whether long liquidations subside.

- Institutional behavior is nuanced — Redemptions from a few big issuers don’t necessarily mean broad institutional exit; it can reflect manager-specific rebalances or cash-raising needs.

Conclusion

The $866.7M outflow on Nov 13 marks a major stress moment for Bitcoin ETFs and the wider crypto market. BTC’s close below $100K, $1.1B in liquidations, and sweeping altcoin losses underscore how quickly flows can translate into price volatility. That said, market structure — including ETF issuance, futures liquidity, and on-chain fundamentals — will determine whether this event is a temporary correction or the start of a deeper retracement.