The crypto market just felt a massive tremor. Fresh data reveals a historic record Bitcoin outflow, with asset management giant BlackRock pulling approximately $473 million from its spot ETF in a single session. This marks the largest USD-denominated withdrawal since the fund launched, intensifying the pressure during a week already dominated by fear and heavy sell-offs.

Record Bitcoin Outflow as BlackRock Withdraws a Staggering $473 Million

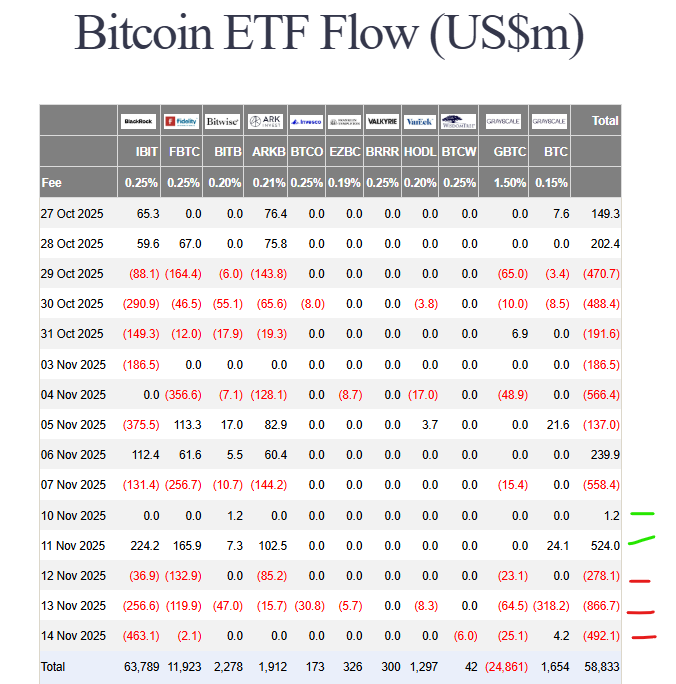

The scale of the movement is breathtaking. According to SoSoValue, the BlackRock Bitcoin ETF (IBIT) saw outflows of $463.10 million. Meanwhile, Fidelity’s FBTC bled over $2 million, and Grayscale’s GBTC continued its exodus with another $25.09 million in outflows. Shockingly, only one smaller Grayscale product provided a minuscule offset of $4.17 million. Other major issuers, including Ark Invest and Bitwise, recorded zero inflows, highlighting a severe liquidity crunch. This mass cash-out suggests institutions aren’t necessarily losing faith in Bitcoin; rather, they are scrambling for dollar liquidity amid market-wide stress.

A Market Split Between Winners and Losers

This institutional flight coincides with a sharp performance divide across the crypto landscape. Analyst Daan Crypto Trades highlighted that most assets have plummeted 10-30% over the past month, while only a handful posted gains above 30%. This creates a brutal environment where diversification fails. Consequently, liquidity is rapidly concentrating in major assets like Bitcoin, forcing traders to stay exceptionally nimble or simply stick to blue-chip cryptos.

My Thoughts

While this record Bitcoin outflow looks alarming, it’s a classic sign of a capital-driven sell-off, not a fundamental breakdown in Bitcoin’s thesis. For savvy investors, this panic creates a potential accumulation zone. When giants like BlackRock are forced sellers due to liquidity needs, it often marks a local bottom. The long-term narrative of scarcity versus money printing remains fully intact.