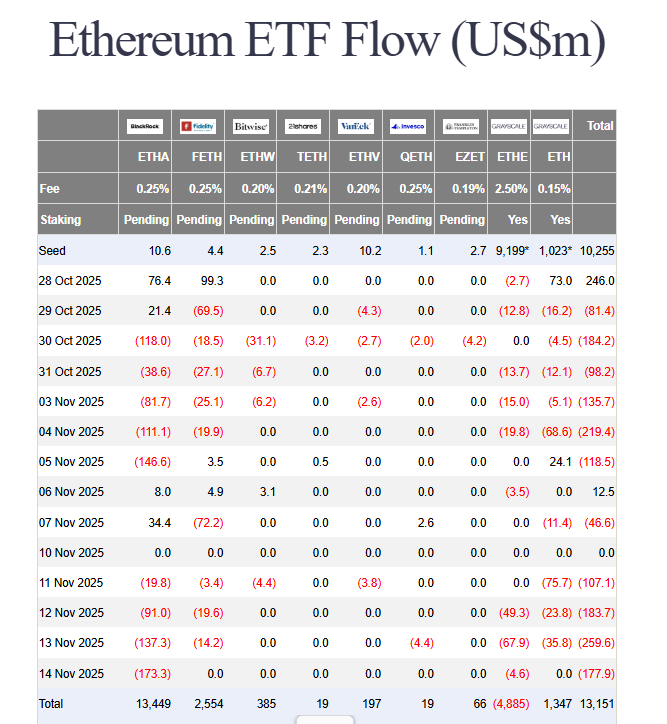

The Ethereum market is facing a severe test this week. A tidal wave of institutional selling has slammed ETH, with U.S. Ethereum ETF outflows showing a staggering $728.3 million over just four days.

Ethereum ETF Outflows Spark Crisis as BitMine Shakes Up Leadership

This brutal streak of Ethereum ETF outflows, including a single-day record $173.3 million withdrawal from BlackRock’s fund, has crushed price momentum and triggered a major corporate shakeup at a key industry giant.

BitMine’s Strategic Pivot Amid the Storm

In direct response to the turmoil, BitMine Immersion Technologies—the world’s largest corporate holder of Ethereum—has announced a sweeping leadership overhaul. The company, which controls a colossal 2.9% of the entire ETH supply, has appointed Chi Tsang as its new CEO. Furthermore, it added three independent directors to its board. Chairman Tom Lee stated this move is essential to position BitMine as the definitive bridge between Ethereum and traditional finance, comparing the current crypto shift to the internet revolution of the 1990s. This reshuffle solidifies the firm’s ambitious goal to acquire 5% of all ETH, signaling extreme long-term conviction despite the short-term market panic.

Technical Breakdown: Can ETH Hold $3,200?

The technical picture for Ethereum has deteriorated sharply alongside the relentless Ethereum ETF outflows. The price has plunged below the 50-day and 100-day moving averages and is now precariously testing the 200-day line near $3,200. Key momentum indicators are flashing warning signs. The RSI is depressed at 36, indicating weak demand, while proprietary models now suggest a 54% probability of a further retrace to $3,000. A decisive break below the $3,200 support could quickly expose lower levels near $3,050 and even $2,850. For any meaningful recovery to begin, buyers need a strong catalyst to reverse the institutional exodus and reclaim the 50-day MA near $3,912—a formidable task in the current environment.

My Thoughts

This is a defining moment for Ethereum. The massive Ethereum ETF outflows are painful, but BitMine’s aggressive leadership change and accumulation goal reveal a stark divide between short-term traders and long-term institutional believers. This sell-off feels more like a liquidity crunch than a broken thesis. If ETH holds $3,200, it could form a powerful base for the next leg up. However, the path of least resistance remains down until the ETF flows reverse.