Bitwise XRP ETF Launch Goes Live with Strong Investor Debut

It’s a monumental day for Ripple fans. The Bitwise XRP ETF (ticker: XRP) has officially begun trading on the New York Stock Exchange, providing U.S. investors with a seamless, regulated way to gain exposure to the digital asset. This pivotal XRP ETF launch recorded a solid $25 million in first-day volume, with 1.14 million shares changing hands. While this fell short of the most optimistic projections, it represents a strong start amid a brutal market-wide sell-off that has crushed altcoin prices.

A Strategic and Secure XRP ETF Launch

Bitwise is pulling out all the stops to ensure this XRP ETF launch succeeds. The fund is physically backed, meaning it holds actual XRP tokens in custody with Coinbase. To protect against market manipulation, its net asset value is pegged to a robust CME benchmark rate. Most enticingly, Bitwise is waiving its entire 0.34% management fee for the first month on the first $500 million in assets. This aggressive promotion is a clear bid to attract early capital and build momentum, demonstrating the firm’s long-term commitment.

The Calm Before the Institutional Storm?

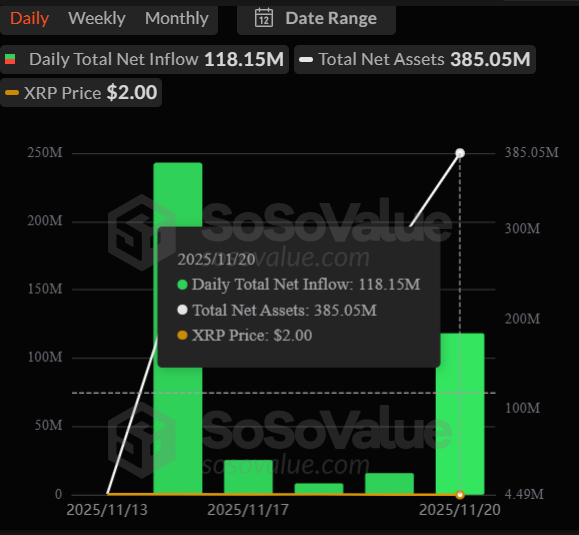

This is just the beginning. The Bitwise fund follows the successful debut of Canary Capital’s XRP ETF, which notched $58 million on its first day. More importantly, a wave of competing funds from giants like Grayscale, Franklin Templeton, and 21Shares is expected to launch in the coming weeks. Industry analysts project these products could collectively attract a staggering $5 to $8 billion in inflows by the end of 2025. This potential wall of institutional money creates a profoundly bullish backdrop, even as the current price of XRP struggles near $1.92.

My Thoughts

Don’t be fooled by the modest volume—this XRP ETF launch is a watershed moment. The real story isn’t one day’s trading; it’s the coming tsunami of institutional products. When the market eventually turns, this regulated infrastructure will funnel massive capital into XRP. The current price pain is creating a perfect accumulation zone ahead of what could be a historic liquidity surge.