The Line in the Sand: Bitcoin’s 6-Week Break from Its Bull Market Channel

A critical technical line has been crossed—and held. Bitcoin has now traded below its defining two-year bull market channel for six consecutive weeks, marking its longest deviation since the uptrend began. This isn’t a brief dip; it’s a sustained break that signals a potential regime shift. The cryptocurrency faces a pivotal moment as it attempts a fourth retest of this former support-turned-resistance. The outcome will likely dictate the trend for early 2026.

Echoes of 2021: A Rounded Top & Miner Capitulation

The current structure bears an unnerving resemblance to the 2021 cycle top. Analysts point to a similar “rounded top” formation, followed by a sharp decline and a struggling rebound. The support level currently being tested is the same one that, in 2021, gave way to a severe bear market.

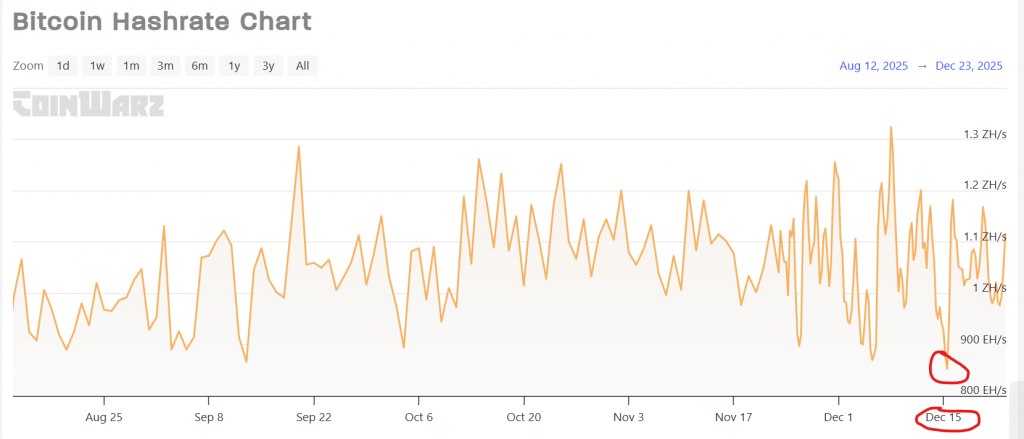

Adding to the concern is on-chain data. VanEck reports a noticeable drop in Bitcoin’s network hashrate in mid-December. Historically, such miner capitulation has coincided with market bottoms, but it also underscores underlying economic pressure on the network’s security providers.

The Santa Rally Myth and a Legend’s $25K Warning

The hopeful “Santa Rally” narrative looks statistically weak. While December’s average return is slightly positive, the data is bimodal—it’s either a huge rally or a sharp drawdown, with recent years favoring the latter. Relying on seasonal cheer is a poor strategy.

Meanwhile, veteran trader Peter Brandt has issued a stark warning. Based on Bitcoin’s historical pattern of parabolic advances followed by 80%+ declines, he projects a potential cycle low of $25,000, with the next bull market peak not due until September 2029. This extreme, yet historically grounded, view contrasts sharply with mainstream price targets.

The Immediate Scenario: A Make-or-Break Retest

All eyes are on the lower boundary of the former bull market channel, now acting as robust resistance near the $88,000-$90,000 zone. Bitcoin is coiling just beneath it. A decisive weekly close back inside the channel could reignite the bullish structure. However, another rejection would confirm its breakdown and open the path toward much lower supports, potentially beginning with a move to $80,000.

My Take

The weight of evidence is leaning bearish for the first time in this cycle. The prolonged break of the bull market channel cannot be ignored. While a final “Santa” squeeze back into the channel is possible, the smarter play is to respect the breakdown until proven otherwise. Brandt’s $25K prediction feels extreme, but it reinforces that downside risk is materially higher than many expect. My focus is on the $88K weekly close. Below that, I’m defensive. Above it, I’ll reconsider.