Institutions Are Stacking SOL: Major Solana ETF Inflows Hit the Tape

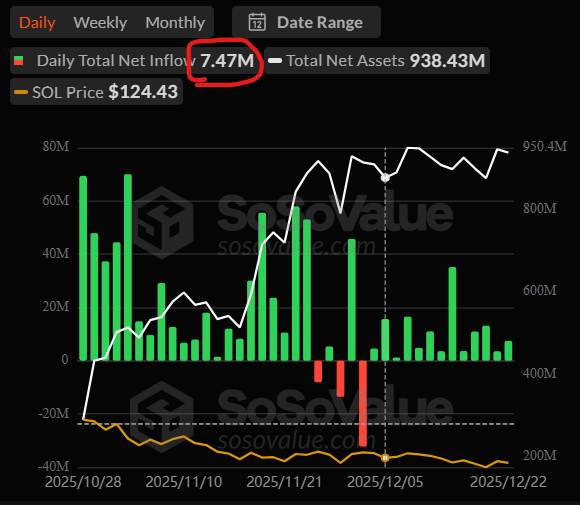

Forget the noise—the smart money is quietly placing its bets. While the broader market dipped, Solana saw a crucial vote of confidence: fresh Solana ETF inflows totaling $7.4 million hit the books in the latest session. This isn’t retail FOMO; this is deep institutional accumulation, signaling a powerful conviction in SOL’s long-term trajectory. With price holding steady above the critical $120 support, this fundamental strength could be the catalyst for the next major breakout.

Solana ETF Inflows: A Closer Look at the Institutional Bet

The recent Solana ETF inflows tell a story of strategic positioning, not short-term speculation. Analysts note that steady, consistent inflows into exchange-traded products typically indicate that large, long-term investors are building a position. This accumulation is happening against a backdrop of phenomenal on-chain performance. Data reveals a historic shift: Solana’s annual protocol revenue is on track to flip Ethereum for the first time ever, with a staggering $1.4 billion generated year-to-date compared to Ethereum’s $522 million. Institutions aren’t just betting on a token; they’re betting on the most used and valuable blockchain economy.

Technical Outlook: The Battle for $120 Support

Technically, SOL is consolidating in a tight range between $120 support and $130 resistance. This is a healthy basing pattern after its recent run. The key for bulls is a firm hold above $120. A bounce from this level with increasing volume could propel a retest of $130 and potentially $140.

However, indicators show near-term caution. The RSI is neutral at 40, and the MACD has turned negative. A decisive daily close below $120 could trigger a deeper pullback toward $112. The current institutional inflows provide a strong fundamental buffer against any severe breakdown.

My Take

This is a classic “see through the noise” setup. The market is down, yet institutions are using the weakness to buy a fundamental powerhouse. The revenue flip is the most bullish narrative in crypto right now, proving Solana’s utility is in hyper-growth. While the price may chop in the short term, the institutional Solana ETF inflows and revenue dominance create a floor of demand. For me, this confirms that any dip near $120 is a strategic buying opportunity, not a reason to panic.