Saylor Speaks: Is a New Wave of Corporate Bitcoin Accumulation Starting?

The oracle has spoken again. Strategy Executive Chairman Michael Saylor just fired a cryptic but potent signal to the market with a simple post: “Back to Orange,” accompanied by a chart of the company’s historic Bitcoin purchases. This phrase is now intrinsically linked to the firm’s aggressive buying strategy, sparking intense speculation that a new round of corporate Bitcoin accumulation is imminent. Coming after a recent pause, this hint could be the precursor to another multi-million dollar move that shakes the market.

Decoding the “Back to Orange” Bitcoin Accumulation Signal

For those fluent in “Saylor-speak,” this is a big deal. His previous “Green Dots” posts have historically preceded major announcements, from massive BTC purchases to strategic treasury shifts. “Back to Orange” directly references the color-coding on his famous accumulation chart, suggesting a return to active buying mode after a brief hiatus last week.

While not an official announcement, Saylor’s communication is never accidental. It’s designed to set market expectations. The signal reinforces Strategy’s identity as a relentless, conviction-driven accumulator, not a speculative trader. If history is a guide, a formal purchase disclosure could follow soon.

The Market’s Cautious Stance: A Contrarian Setup

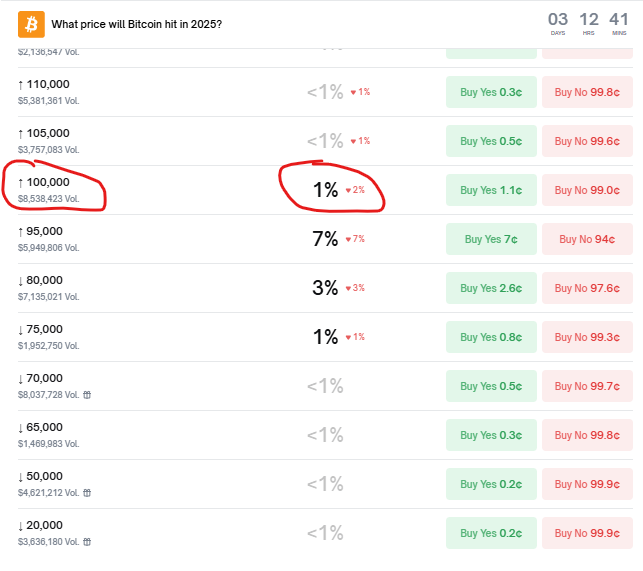

Interestingly, this hint clashes with current market sentiment. Prediction markets like Polymarket assign a mere 1% probability to Bitcoin reaching $100,000 by year-end. The highest odds cluster around a modest $95,000 target. This widespread pessimism creates a classic contrarian setup.

Technically, analyst Ted Pillows points out that the Bitcoin-to-stablecoin ratio is testing a major monthly support zone—a level that has catalyzed significant rallies in the past. This suggests that while sentiment is low, the underlying structural demand may be quietly building.

My Take

This is the ultimate “watch what they do, not what they say” moment. While the crowd bets on low price targets, the largest corporate BTC holder is hinting at buying more. This divergence is pure alpha. Saylor uses these signals to communicate with the market at precise technical junctures. If Strategy resumes its Bitcoin accumulation with prices subdued, it would be a powerful validation of the long-term thesis and could trigger a violent short squeeze. My play is to watch for a follow-up filing. If it comes, it’s rocket fuel.