Institutional Pause: Bitcoin ETF Outflows Surge to $681M Weekly

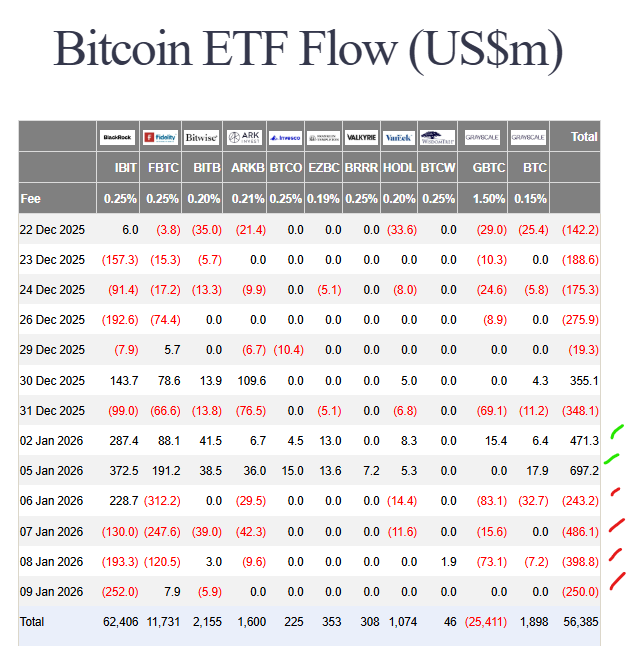

The institutional euphoria that kicked off 2026 has hit a sudden wall. U.S. spot Bitcoin ETF outflows have accelerated dramatically, with four consecutive days of redemptions totaling a massive $681 million for the week. This stark reversal from the strong inflows of early January signals a rapid shift to “risk-off” positioning among major investors, driven by growing macroeconomic uncertainty.

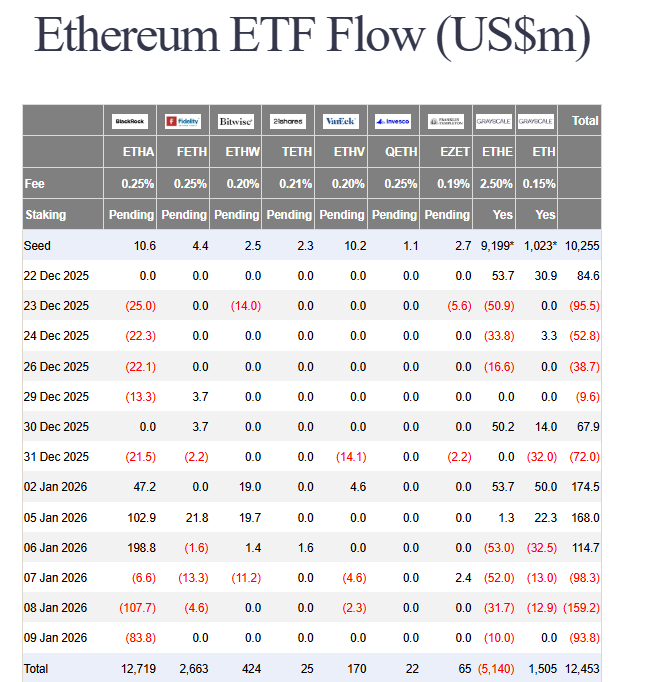

The selling was consistent and heavy. Outflows peaked at $486 million on Wednesday, followed by $398.9 million on Thursday. This trend pulled weekly flows deep into negative territory, completely overshadowing the $1.16 billion inflows from the first two trading days of the year. Spot Ethereum ETFs mirrored the move, also ending the week with net outflows as caution spread across the digital asset sector.

The Macro Drivers Behind Rising Bitcoin ETF Outflows

So, what triggered this institutional pullback? Analysts point to a deteriorating macroeconomic landscape. Expectations for imminent Federal Reserve rate cuts in Q1 have faded, while rising geopolitical tensions are adding to risk aversion. In the Other hand, JPMorgan is saying the heavy selling in crypto already looks done. ETF outflows on Bitcoin and Ethereum will cool off, profit-taking from late 2025 seems mostly finished, and the whole drop looks more technical than fundamental.

Investors are now in a holding pattern, awaiting clearer signals. All eyes are on upcoming U.S. CPI data and Fed commentary for hints about the future path of monetary policy. Until then, the appetite for risk assets like Bitcoin is likely to remain subdued, explaining the persistent Bitcoin ETF outflows. This is a classic “wait-and-see” moment for macro-driven capital.

My Thoughts

This is a healthy, albeit painful, macro-driven cleanse. The outflows are not a rejection of Bitcoin’s thesis but a reflection of global portfolio adjustments. It highlights that Bitcoin is now firmly traded as a macro liquid asset. The silver lining? This selling is happening through regulated ETFs—it’s transparent, measurable, and likely represents short-term tactical moves, not a long-term strategic exit. Once the macro dust settles and clarity returns, these same conduits will facilitate the return of capital. Patience is key.