Privacy Goes Parabolic: Monero Price Surge Shatters $600 ATH

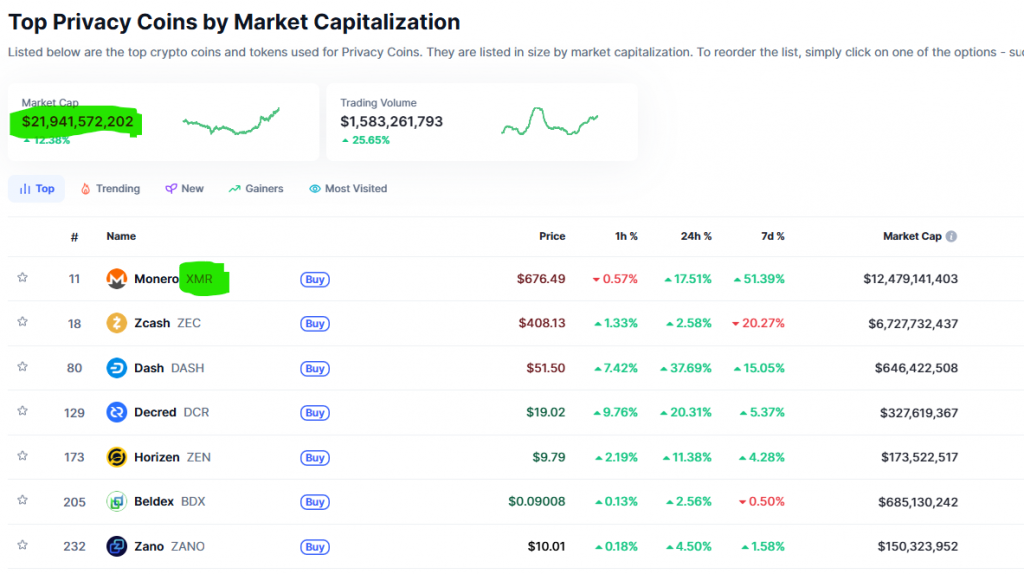

The ultimate privacy champion is making history. In a stunning display of strength, Monero (XMR) has shattered the $600 barrier for the first time ever, catapulting to a new all-time high above $677. This monumental Monero price surge —a 51% weekly rally—is leading the entire privacy coin sector to a collective $21.9 billion market cap and decisively outperforming the broader crypto market.

This isn’t just a pump; it’s a powerful breakout after nearly seven months of consolidation. XMR has now decisively dethroned Zcash (ZEC) as the sector leader, creating significant distance as it enters price discovery mode. The rally even drew comparisons from veteran trader Peter Brandt, who noted a similarity to silver’s historic rallies and pointed to a broken descending resistance trendline, hinting at the potential for a legendary “god candle.”

Analyzing the Drivers of the Monero Price Surge

What’s fueling this historic move? Crucially, the Monero price surge is happening against the grain of a slightly down broader market, confirming this is a targeted rotation into privacy assets. On-chain data reveals a fascinating narrative: while social media hype (FOMO) actually declined, development activity spiked significantly. This combination—strong fundamentals with low retail chatter—often signals organic, sustainable growth.

Furthermore, the Monero community’s deep conviction is evident. The project secured a $1 million development fund from community donations in late 2025, ensuring its roadmap progresses independently. This resilience, even after Binance’s delisting in 2024, demonstrates a powerful, decentralized network effect that is now being rewarded by the market.

My Thoughts

This is a watershed moment for privacy coins. Monero’s breakout validates the intense, growing demand for financial privacy in an era of increasing surveillance and regulatory scrutiny. The fact that this surge is driven by fundamentals and not hype makes it particularly durable. This could trigger a major capital rotation from transparent chains into the privacy sector, with XMR as the primary beneficiary. It’s a stark reminder that in crypto, foundational principles like censorship-resistance and privacy remain priceless.