Bearish Clouds Gather: Ethereum Price Analysis Points to Crucial Breakdown Risk

The pressure on Ethereum is mounting. Our latest Ethereum price analysis reveals ETH is trapped in a tightening symmetrical triangle pattern that has been forming since November, and the risk of a bearish breakdown is rising. Currently trading near $3,134, Ethereum has dropped 5% from its January high, struggling under the weight of persistent whale selling and worrying capital outflows.

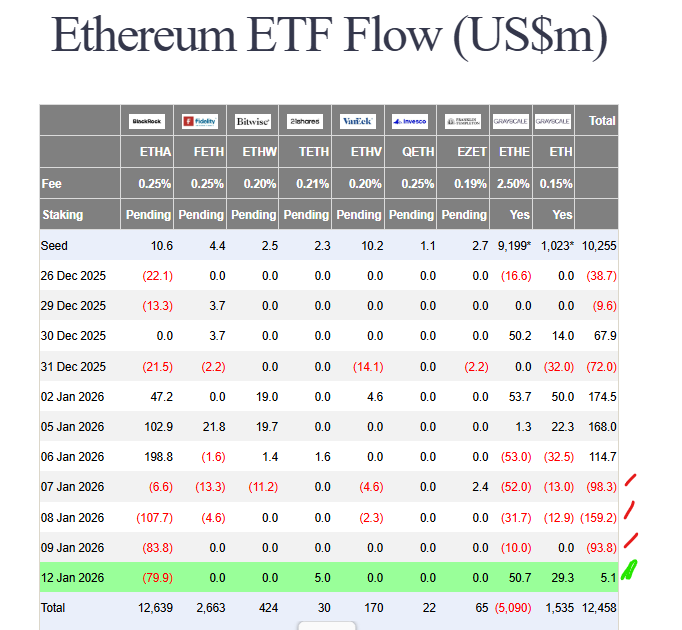

The data paints a clear picture of institutional retreat. Major whales (wallets holding 10k-1M ETH) have been steadily distributing their holdings since mid-December. This selling pressure is compounded by a stark lack of institutional demand; U.S. spot Ethereum ETFs have bled over $345 million in just four days. Furthermore, the Total Value Locked (TVL) in Ethereum DeFi has plummeted from $97B to $72B, signaling a worrying drop in network utility and user confidence.

Critical Levels in Our Ethereum Price Analysis

Our technical Ethereum price analysis identifies two concerning patterns converging. The immediate threat is the symmetrical triangle on the daily chart. A decisive close below its lower trendline would signal a bearish continuation, likely triggering a swift move toward the $3,000 psychological support.

Beyond that, a larger-scale inverse cup and handle pattern looms. Its neckline sits at $2,619, aligning with the November 21 low. A breakdown below $3,000 would put this critical level in focus. If that fails, our Ethereum price analysis suggests a path could open toward $2,121. The only bullish invalidation would be a powerful reclaim above the $3,269 resistance.

My Thoughts

This is a critical juncture for Ethereum. The combination of technical precarity and fundamental outflows is toxic in the short term. Whales appear to be de-risking ahead of potential macro uncertainty, and retail is following suit. The $3,000 level is now the line in the sand. If it breaks, the sentiment damage could lead to a rapid washout toward $2,600. However, if ETF flows reverse and the triangle resolves upward, the squeeze could be explosive. For now, caution is paramount.