Whale Watch: Saylor’s Bitcoin Accumulation Strategy Nears Another Mega Purchase

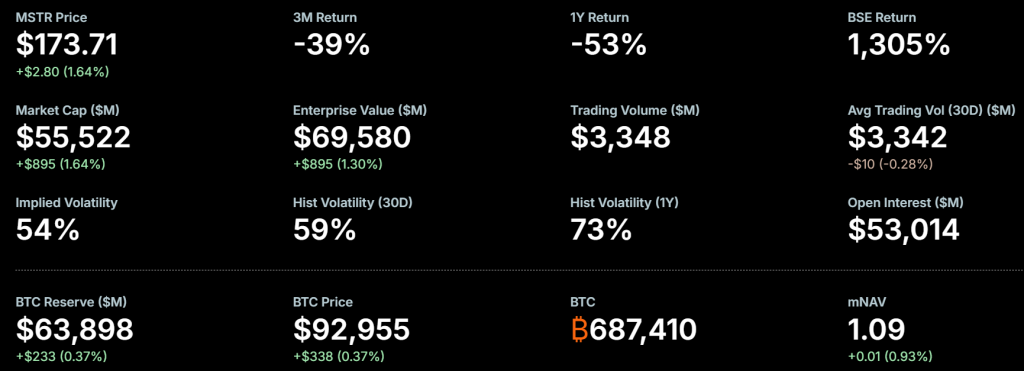

The signal is clear. Michael Saylor has telegraphed another colossal move, posting a cryptic “Bigger Orange” chart that traces his relentless Bitcoin accumulation strategy. His firm, Strategy, now holds a staggering 687,410 BTC—over 3% of Bitcoin’s total finite supply. This isn’t just investing; it’s a systematic campaign to corner a foundational scarce asset, and all signs point to the next billion-dollar buy being imminent.

Saylor’s chart posts have historically preceded major purchases, like last week’s $1.25 billion acquisition of 13,627 BTC. With an average cost basis of $75,000 and BTC near $95,000, the firm’s unrealized gains are monumental. This Bitcoin accumulation strategy, funded through equity and debt, has made Strategy a de facto publicly-traded Bitcoin ETF, but with aggressive leverage to BTC’s upside.

Market Impact of This Relentless Bitcoin Accumulation Strategy

While BTC holding $93k after dropping to $91K, MSTR stock has only recently begun to reflect this value, up 12% YTD after MSCI decided against restrictive index changes. The stock often acts as a leveraged proxy for Bitcoin, suggesting a new purchase could ignite its next leg up.

However, the broader BTC market shows caution. Analysts note heavy liquidity clusters between $96,000 and $98,000, which could act as a short-term magnet or resistance zone. Despite corporate buying, trader positioning remains mixed, with institutional futures activity rising but overall momentum needing a catalyst to break through overhead supply.

My Thoughts

Saylor isn’t just buying Bitcoin; he’s executing a sovereign-grade accumulation strategy in plain sight. Controlling 3% of the total supply is a staggering achievement that creates permanent upward pressure on price. Each purchase tightens available liquidity, making Bitcoin increasingly scarce for other institutions. While short-term price may wrestle with resistance, the long-term narrative is undeniable: one of the world’s most disciplined CEOs is betting his entire corporate treasury on Bitcoin. When the next buy hits, it will send a powerful message to every boardroom globally.