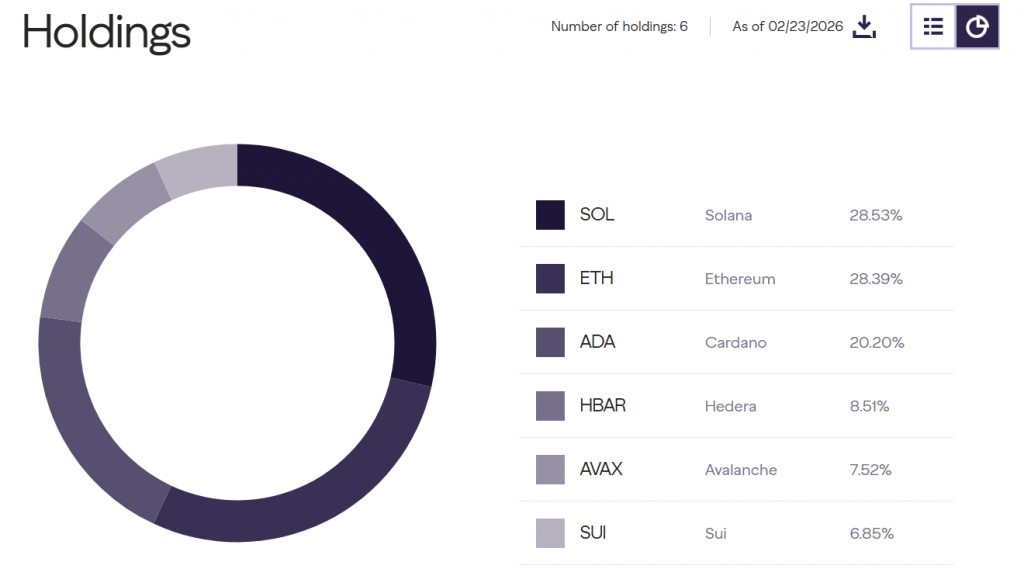

Institutional conviction in Cardano is growing—even as the broader market bleeds. Grayscale Investments has increased its Cardano allocation to 20.20% in its diversified crypto fund, making ADA the third-largest holding behind Solana (28.53%) and Ethereum (28.39%). The move signals confidence in Cardano’s long-term fundamentals despite the current macro-driven volatility that has Bitcoin plunging below $65,000 and altcoins trading sharply lower.

Grayscale Cardano Allocation Climbs to 20.20%

The portfolio rebalancing comes at a turbulent moment for crypto markets. Trump’s fresh tariff measures triggered a broad risk-off move, with Ethereum, Solana, and Cardano all posting weekly losses. Yet Grayscale’s increased exposure suggests that institutional investors are looking through short-term noise and positioning for the next cycle.

Cardano now commands a larger share of the fund than assets like Avalanche and Chainlink, reflecting growing recognition of its smart contract platform potential and developer ecosystem.

ADA Price Analysis: Key Levels to Watch

Despite the institutional tailwind, ADA’s technical picture remains fragile. The token trades near $0.257, down nearly 2% on the session. The daily chart shows a clear downtrend from January highs near $0.42, with a series of lower highs and lower lows into February.

- Immediate resistance: $0.30–$0.31 zone. A sustained break above this level is needed to shift momentum.

- Critical support: $0.24 must hold. A breakdown could trigger a retest of the $0.22 swing low.

- Momentum indicators: Awesome Oscillator remains negative but shows fading bearish momentum. Balance of Power still below zero, indicating sellers retain control.

My Thoughts

The Grayscale Cardano allocation increase is a classic “smart money” signal. While retail panic-sells into macro weakness, institutional allocators are quietly rebalancing toward projects with proven development roadmaps.

Cardano’s inclusion at 20% tells me Grayscale’s research team sees something the broader market currently ignores: fundamental value at discounted prices. The timing—during a tariff-driven rout—is deliberate. This is accumulation, not momentum-chasing.

For ADA holders, this provides a powerful psychological floor. The largest digital asset manager just increased exposure. That doesn’t guarantee a price rally, but it does suggest that sub-$0.30 ADA is attracting institutional interest.

Technically, $0.24 is the line in the sand. If that holds, this becomes a high-probability accumulation zone. A break below $0.22 would challenge even Grayscale’s conviction.