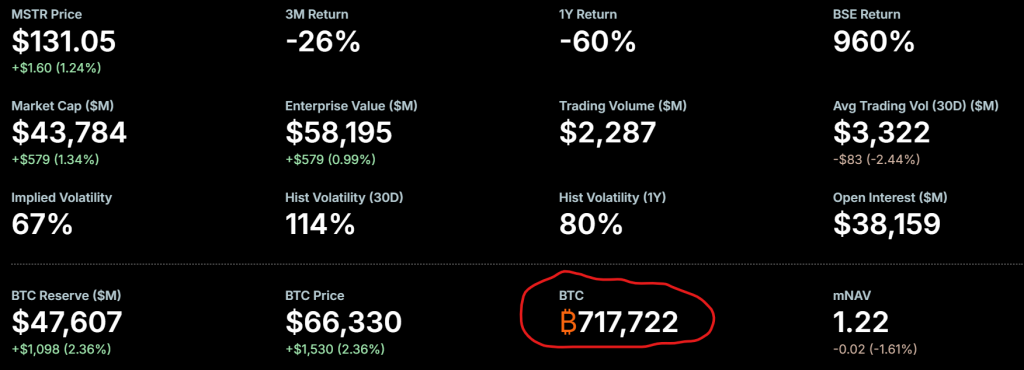

The accumulation machine never stops. Michael Saylor’s Strategy has completed its 101st Bitcoin purchase, acquiring 3,015 BTC for $204.1 million between February 23 and March 1 . This marks the company’s 10th consecutive weekly purchase, extending a streak that began in December 2025. The latest buy comes as Bitcoin holds steady above $65,000 despite escalating US-Iran military conflict .

The Strategy Bitcoin Purchase: 101 and Counting

According to the SEC filing, Strategy acquired the coins at an average price of $67,700 per BTC . Total holdings now stand at 720,737 BTC—approximately 3.4% of Bitcoin’s ultimate supply cap—acquired for $54.77 billion at an average cost of $75,985 per coin .

The purchase was funded through at-the-market sales of 1.73 million MSTR shares ($229.9 million) and 71,590 STRC preferred shares ($7.1 million) . Strategy’s “42/42” plan targets $84 billion in capital raises through 2027 to fund further accumulation .

Saylor teased the acquisition with his customary Sunday X post, sharing the company’s Bitcoin tracker with the caption “The Turn of the Century” .

Market Context: Buying Through War and Weakness

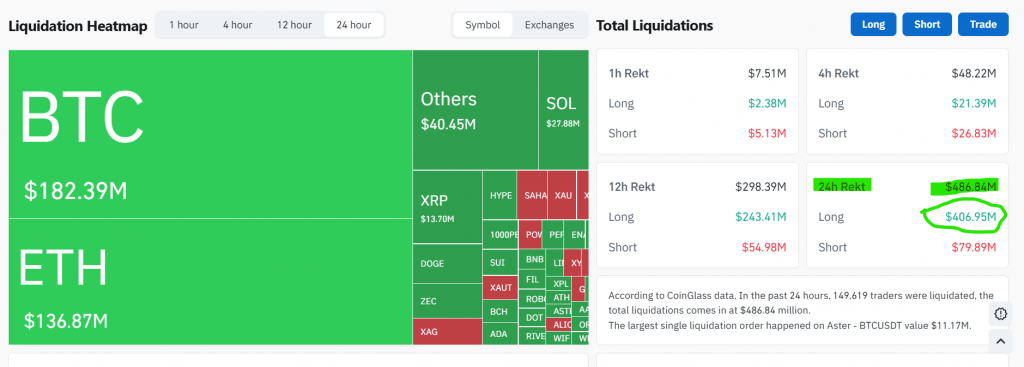

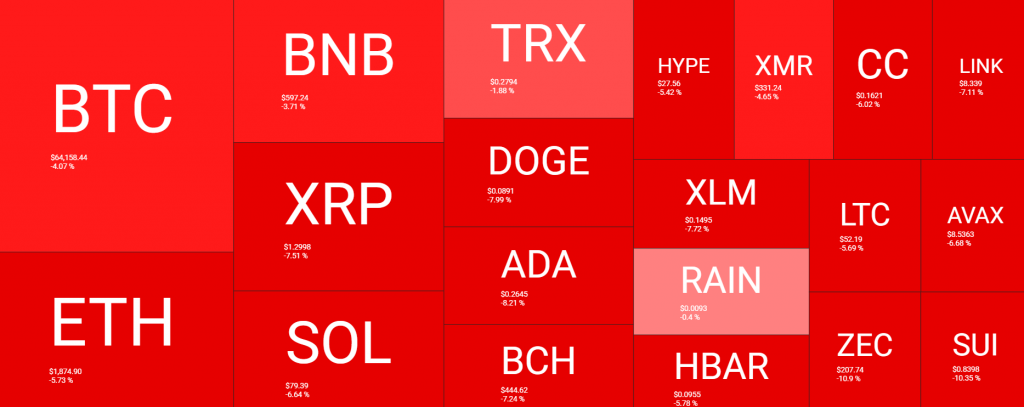

This Strategy Bitcoin purchase arrives during a period of significant geopolitical stress. US and Israeli forces launched coordinated strikes on Iran over the weekend, briefly pushing BTC to $63,000 . However, Bitcoin has since recovered to trade near $69,400, demonstrating resilience that contrasts with earlier panic selling .

Short-term holder behavior supports this stability. Unlike the February 5-6 capitulation that saw 89,000 BTC sent to exchanges at a loss, the recent dip triggered no surge in panic selling . Analysts suggest the weak hands have already exited .

MSTR Stock Opens Green

Strategy’s stock opened Tuesday’s session at $133, up over 2% from last week’s close, mirroring Bitcoin’s recovery . MSTR traded as high as $137.98 mid-day, reflecting renewed investor confidence despite the company’s $7.3 billion unrealized loss position .

The $7 Billion Paper Loss Paradox

Strategy’s average entry price of $75,985 sits well above current spot prices, creating a $7.3 billion unrealized loss on paper . Yet leadership remains unfazed. The company has previously modeled that even a drop to $8,000 Bitcoin sustained through 2032 wouldn’t force liquidation, given its debt structure and cash reserves .

STRC Dividend Hike Boosts Appeal

Strategy increased the STRC perpetual preferred stock dividend rate by 25 basis points to 11.50% for March . This marks the seventh straight monthly increase since July 2025, enhancing the instrument’s appeal to income-focused investors. STRC has become a “primary engine” for funding Bitcoin acquisitions, according to Benchmark analysts .

My Thoughts

A Strategy Bitcoin purchase at this scale—$204 million during a geopolitical crisis—sends an unmistakable signal: price is irrelevant; accumulation is the strategy. The 10-week streak demonstrates programmatic discipline that transcends short-term volatility.

The $7.3 billion paper loss narrative misses the point. Strategy’s balance sheet is structured to withstand a multi-year bear market . The $8,000 stress test scenario reveals a fortress mentality: if they survive that, current levels are merely a dip.

For the broader market, this creates a structural bid that compounds weekly. Each purchase removes coins from circulation, tightening supply precisely when weak hands capitulate. The STRC dividend increase adds an institutional-grade yield vehicle tied directly to Bitcoin accumulation—a novel hybrid that attracts income capital to the treasury thesis.

The geopolitical resilience is equally significant. Bitcoin’s muted reaction to the Iran strikes suggests the selling pressure is exhausted . When war can’t trigger panic, the foundation for the next leg up is being laid.