In a significant move for decentralized finance, Pendle Finance Integration with Plasma was announced . Consequently, this partnership will provide global users, including the unbanked, with direct access to Pendle’s sophisticated yield-generating products.

Details of the Pendle Finance Integration

The Pendle Finance integration will initially launch five yield markets on the Plasma network. Specifically, these markets feature a range of high Annual Percentage Yields (APYs), such as a massive 649% on the sUSDai pool.

To further incentivize participation, Pendle confirmed that $900,000 in XPL tokens will be distributed weekly. As a result, both Yield Token holders and liquidity providers can expect significantly boosted returns. Meanwhile, Principal Token investors will benefit from the opportunity to lock in higher fixed rates.

Strategic Context and Market Impact

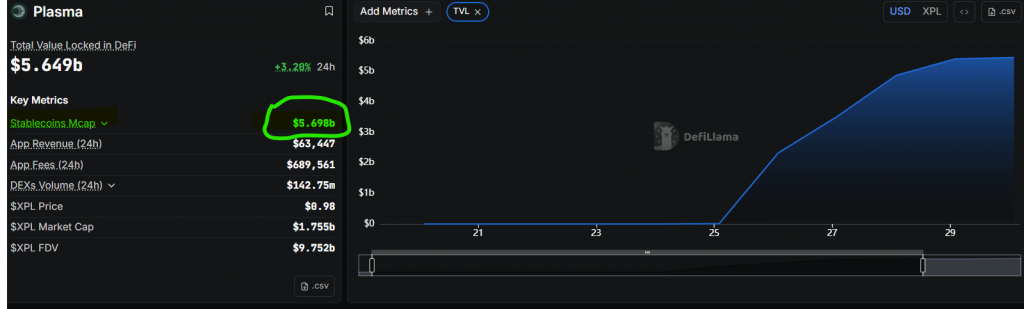

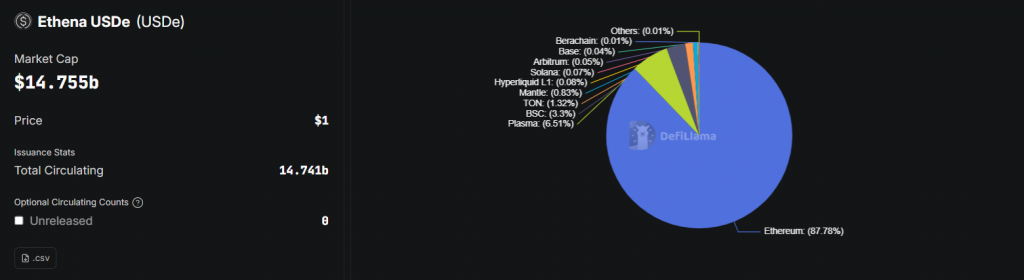

This Pendle Finance integration builds directly on the momentum from Plasma’s recent mainnet beta launch. Initially, that launch seeded over $2 billion in stablecoin liquidity. Therefore, Pendle is strategically positioning itself to tap into this deep liquidity, particularly for Ethena’s USDe, which has a circulating supply exceeding $13 billion.

The Bottom Line

Ultimately, the Pendle Finance integration with Plasma represents a powerful fusion of DeFi innovation and scalable infrastructure. By doing so, it unlocks unprecedented yield opportunities for a global audience and marks a significant step toward mainstream DeFi adoption.