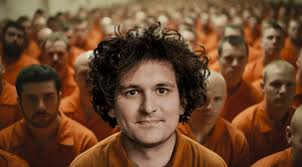

A year ago today, authorities arrested Sam Bankman-Fried, the FTX founder, on charges of defrauding customers, investors, and lenders. His trial became a headline event for Yahoo Finance in 2023, representing a pivotal moment due to his prominent role in the crypto realm’s meteoric ascent and subsequent decline.

Bankman-Fried’s arrest marked a significant episode in a government crackdown on major crypto figures, reshaping the industry’s landscape. The alleged cause of Bankman-Fried’s legal woes was a $9 billion deficit within FTX, leading to the platform’s bankruptcy in November 2022.

The Justice Department’s core claim was that Bankman-Fried intentionally misappropriated up to $14 billion in FTX customer funds, diverting these funds to his earlier venture, Alameda Research. Prosecutors asserted that this money was used for high-risk investments, substantial real estate acquisitions, and political contributions.

During the trial, Bankman-Fried and his three top executives were accused of granting Alameda secret access to FTX’s customer deposits. Testimonies from former allies turned government witnesses painted a compelling narrative, alleging Bankman-Fried’s active involvement in the misuse of customer funds. Despite his testimony in defense, the jury found him guilty on all seven charges after just four hours of deliberation.

Bankman-Fried’s future remains uncertain as he awaits sentencing, facing a potential 110-year prison term and additional charges of bank fraud and bribery. The former FTX executive team, who testified against him for plea deals, also anticipates sentencing in 2024.