A New Era for DeFi: Uniswap’s UNI Fee Switch is LIVE

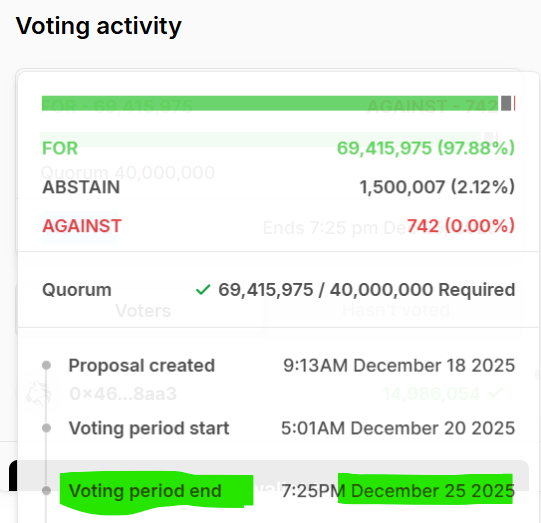

History is being made in decentralized governance. Uniswap’s monumental “UNIfication” proposal has officially crossed the quorum, with over 69 million UNI votes in favor and virtually zero opposition. This landslide vote activates the long-awaited UNI fee switch, fundamentally transforming the token from a passive governance tool into a powerful, revenue-accruing asset. The days of UNI being disconnected from the protocol’s massive success are over.

What the UNI Fee Switch Actually Means

Simply put, a portion of every trade on Uniswap will now benefit UNI holders directly. The proposal redirects roughly one-sixth (about 16.6%) of all protocol trading fees into a treasury pool dedicated to buying and burning UNI tokens from the open market. This creates a direct, automated link between platform usage and token value.

Based on current volumes, this translates to an estimated $130 million per year flowing into the buy-and-burn mechanism. Furthermore, the proposal includes a massive one-time burn of 100 million UNI (worth ~$940M) from the treasury. This is a classic supply shock narrative, powered by real cash flow.

Beyond the Burn: A Complete Protocol Overhaul

The changes run even deeper. The proposal consolidates Uniswap Labs and the Uniswap Foundation into a unified, execution-focused entity. This shifts the protocol away from a slow, grant-based governance model toward a nimble, growth-oriented structure designed to compete aggressively in the evolving DeFi landscape.

This isn’t just a tweak; it’s a full-stack upgrade aligning tokenomics, governance, and operational strategy for the first time.

My Take

This is the single most bullish structural update for a major DeFi token ever. The UNI fee switch finally solves the “value accrual” problem that has plagued governance tokens for years. Uniswap does ~$150B in monthly volume; even a small slice is transformative. This sets a precedent that will force every other major DeFi protocol to follow suit or risk irrelevance. For holders, this is the moment UNI graduates from a speculative proxy to a foundational, yield-generating blue-chip asset. The re-rating starts now.