CoinMarketCap has just launched the CMC20 Index Token $CMC20

CMC20 Index Token Launches as Crypto’s First DeFi-Native S&P 500

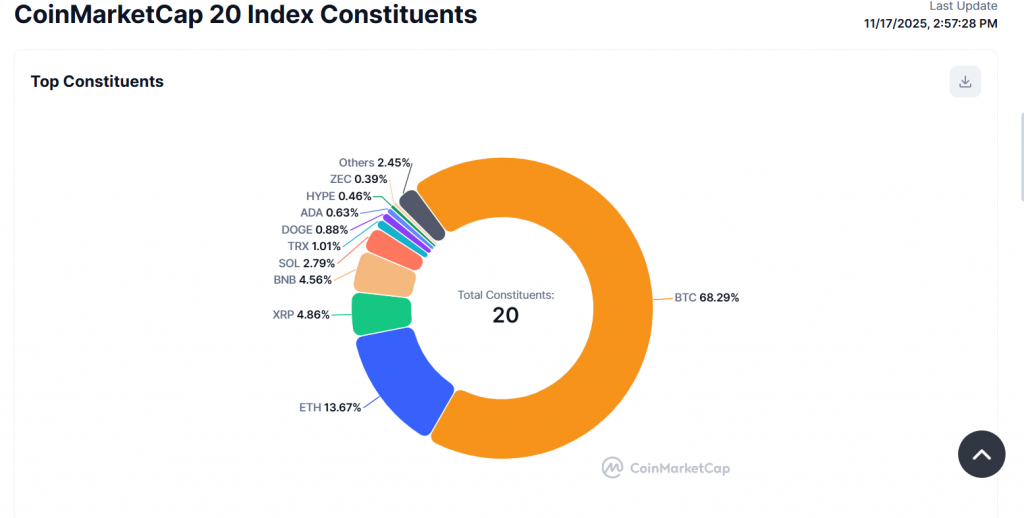

Cut through the noise and diversify like a pro. CoinMarketCap has just launched the $CMC20, a groundbreaking tradable index token that acts as your all-in-one gateway to the crypto market’s giants. This isn’t just a watchlist; it’s the first CMC20 index token built for DeFi, giving you instant, diversified exposure to the top 20 cryptocurrencies by market cap—all through a single trade on BNB Chain.

Your One-Click Crypto Portfolio

Why struggle to build a portfolio manually when you can own the market in one click? The CMC20 index token tracks the largest assets—excluding stablecoins—spanning major layer-1 blockchains, DeFi blue-chips, and exchange tokens. Think of it as crypto’s answer to the traditional S&P 500. It’s designed for both beginners seeking simple diversification and veterans looking for efficient delta-neutral strategies. Simply swap for $CMC20 on PancakeSwap or mint it via the Reserve dApp, and you’re instantly invested in a weighted basket of the market leaders.

Why This is a DeFi Game-Changer

Built in partnership with Reserve Protocol and deployed by Lista DAO, $CMC20 is native to BNB Chain. This choice is strategic, leveraging BNB’s deep liquidity and low fees for seamless trading and composability. Furthermore, it opens up powerful DeFi utilities that a traditional index fund can’t match. Institutions can use it for collateralized lending and automated portfolio rotation, while retail users benefit from lower transaction costs and zero rebalancing headaches. The entire system is transparent and on-chain, providing unparalleled auditability.

My Thoughts

This is a monumental step for crypto adoption. $CMC20 fundamentally lowers the barrier to entry for sound portfolio management and brings institutional-grade index products on-chain. The DeFi composability is the killer feature, turning a static index into a dynamic financial tool. This could rapidly become the base layer for a new wave of structured products and automated wealth management strategies in Web3.