RedotPay’s Mega-Round Signals Stablecoin Financial Services is Booming

Hong Kong fintech powerhouse RedotPay just announced a massive $107 million Series B funding round, catapulting its total raise to nearly $200 million. Led by Goodwater Capital, this round features heavyweight participation from Pantera Capital, Blockchain Capital, and Circle Ventures. This monumental vote of confidence underscores the explosive demand for next-generation, stablecoin financial services.

Building the Future of Global Crypto Finance

RedotPay, now valued at $1 billion, plans to use this capital to accelerate product innovation and expand its global footprint. CEO Michael Gao stated the firm’s mission is to help users “manage their finances with confidence” through stablecoin-based tools. He emphasized that beyond capital, their investors provide crucial expertise to scale responsibly while prioritizing compliance and user experience.

This funding round is a direct bet on the infrastructure layer that bridges digital assets with everyday financial activity. With backing from crypto-native giants like Pantera and Circle, RedotPay is positioned to become a leading global gateway for seamless, stablecoin-centric banking and payment solutions.

2025: The Undisputed Year of the Stablecoin

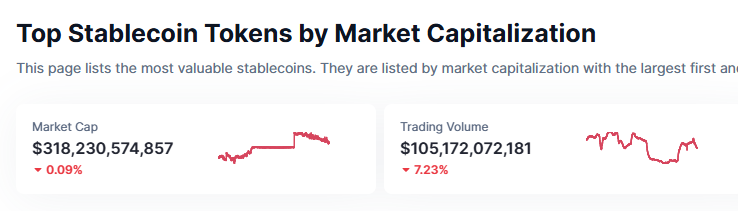

This news arrives during a historic year for stablecoins. While crypto markets have faced volatility, stablecoins have shattered records, reaching a $318 billion total market cap. This growth represents a staggering 50%+ expansion since January 2025.

Furthermore, RedotPay’s success is part of a larger trend. On the same day, SBI Holdings announced a yen-backed stablecoin project, and Visa launched its USDC settlement in the U.S. Clearly, institutional and fintech momentum is overwhelmingly converging on stablecoin utility, not just as a crypto trading pair, but as the backbone for a new global financial system.

My Thoughts

This isn’t just another funding announcement. This is a clear signal that sophisticated capital is betting big on stablecoins as the primary use case for blockchain in finance. RedotPay’s raise, alongside Visa’s and SBI’s moves, proves the infrastructure phase is here. For investors, the alpha is in the picks-and-shovels companies building the compliant rails for this new economy. RedotPay is now a frontrunner.