Despite the broader market downturn and four consecutive days of outflows from both Bitcoin and Ethereum ETFs, Altcoin ETFs inflows continue to surprise investors.

On November 3rd, while the crypto market fell for the second straight day, Solana, HBAR, and Litecoin ETFs each recorded positive net inflows — signaling growing institutional interest in alternative digital assets.

Market Overview: Red Charts, Rising Altcoin Confidence

The overall crypto market had a rough start to November.

Bitcoin ETFs saw $186.5 million in net outflows, and Ethereum ETFs recorded $135 million in withdrawals — both marking their fourth consecutive day of losses.

The total crypto market capitalization dropped to $3.46 trillion, with the fear index down to 27 and the CMC Altcoin Season Index also at 27, both indicating rising bearish sentiment.

Even so, Altcoin ETFs inflows tell a different story — one of resilience and potential early accumulation by institutional investors.

Solana ETF Rockets Despite Price Drop

Leading the pack, the Solana ETF saw a massive $70.1 million net inflow on November 3rd, its biggest single-day inflow to date.

That brings its total net inflows to $296 million and pushes total net assets over $513.35 million.

This surge came even as Solana’s price fell more than 19% over the week to $161, showing that institutions may be viewing the dip as a buying opportunity rather than a warning sign.

The performance of the Solana ETF highlights growing belief in the network’s long-term fundamentals and ecosystem strength, despite short-term volatility.

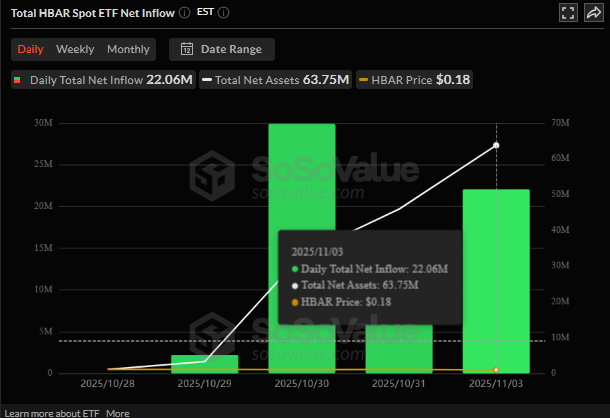

HBAR ETF Posts Second-Best Day Ever

The HBAR ETF followed closely, posting its second-best trading day ever with $22.06 million in net inflows on November 3rd.

That brings total net assets to $63.75 million in just five trading days — a strong debut for a newly launched product.

Even as HBAR’s spot price declined 14% this week to around $0.1759, ETF investors appear to be positioning early, possibly anticipating institutional adoption and use-case expansion around Hedera’s enterprise network.

Litecoin ETF Grows Steadily Amid the Chaos

While smaller in size, the Litecoin ETF quietly maintained positive traction.

On November 3rd, it posted a modest inflow despite widespread selling pressure, bringing its total net assets to $2.35 million.

Given Litecoin’s weekly price drop of over 13% to $87.41, the steady interest shows that even legacy altcoins are finding a renewed niche in institutional portfolios.

Altcoin ETF Inflows Signal a Shift in Market Behavior

The rise in Altcoin ETFs inflows, despite a bearish market and falling prices, could indicate an important shift.

While traditional investors continue to offload Bitcoin and Ethereum positions, capital is rotating into alternative assets — possibly signaling early-stage diversification and long-term confidence in blockchain ecosystems beyond the two market leaders.

Conclusion: Green Shoots in a Red Market

Even as fear rises and markets retreat, Altcoin ETFs inflows reveal a growing institutional appetite for diversification.

With Solana, HBAR, and Litecoin ETFs each showing strength during a market correction, investors seem to be sending a clear message: the next wave of opportunity in crypto might be coming from beyond Bitcoin and Ethereum.