Arbitrum is making a massive play to supercharge its decentralized finance (DeFi) ecosystem. The layer-2 network has launched the DeFi Renaissance Incentive Program (DRIP), a $40 million initiative designed to reward users for productive activities like lending and leverage looping with ARB tokens.

How the DRIP Program Works

Managed by Entropy Advisors and powered by Merkl, the program is rolling out across four “seasons.”

Season One, running from September 3 to January 20, focuses specifically on incentivizing leverage looping strategies in DeFi lending markets.

Here’s a simple example of how it works:

- A user deposits syrupUSDC into a lending protocol like Aave.

- They borrow USDC against that collateral.

- They swap the borrowed USDC back into more syrupUSDC.

- They redeposit it, repeating the loop to increase their exposure.

Rewards are calculated based on the user’s time-weighted average borrow balance over two-week epochs. Some markets also reward users for simply supplying assets like wstETH, weETH, or stablecoins.

How to Participate and Earn ARB

Getting started is straightforward:

- Bridge eligible assets to Arbitrum One.

- Choose a participating lending market (e.g., Aave, Morpho, Fluid, Euler, Dolomite, or Silo).

- Deposit collateral, borrow, and loop.

- Claim your ARB rewards at the end of each two-week epoch.

A Phased Approach for Maximum Impact

The program uses a smart, phased approach to ensure its success:

- Discovery Phase (First Two Epochs): Only 15% of the budget is allocated. This helps identify the best-performing markets.

- Performance Phase: The top-performing markets then receive a larger share of the incentives, creating healthy competition and efficiently driving liquidity to the most useful protocols.

The Goal: Boost Arbitrum’s DeFi TVL

This initiative has a clear goal: significantly increase the Total Value Locked (TVL) across Arbitrum’s DeFi ecosystem.

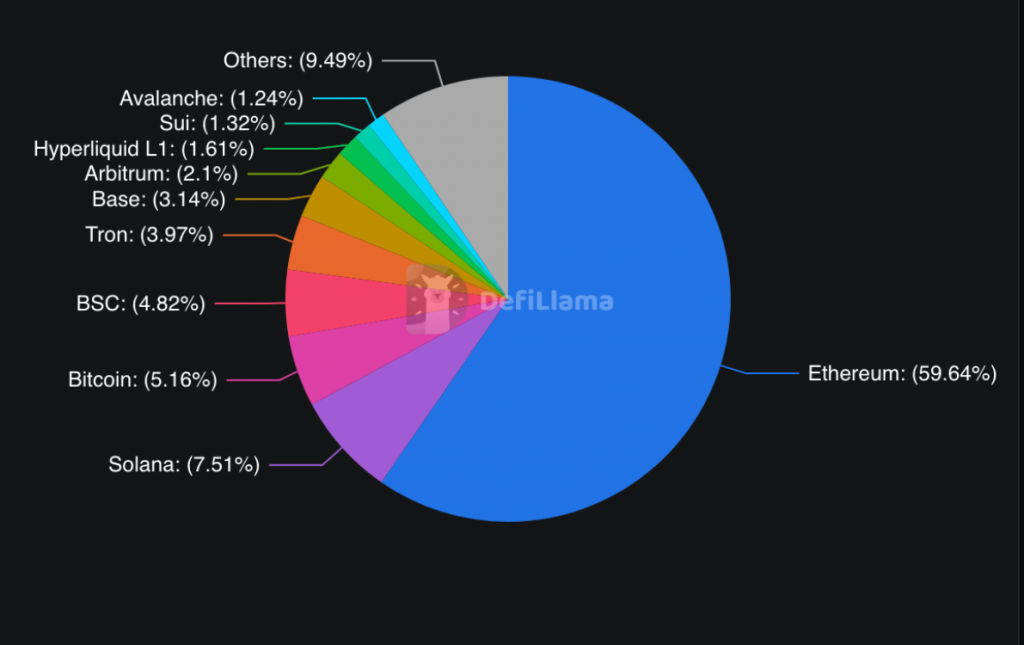

to DefiLlama, Arbitrum currently holds the 7th largest DeFi TVL at $3.21 billion, just behind Base. By directly incentivizing the capital-efficient use of assets, the DRIP program is a strategic move to close that gap and solidify Arbitrum’s position as a top DeFi destination.

The Bottom Line

The DRIP program is a classic example of a well-designed liquidity mining initiative. It doesn’t just reward mindless farming; it specifically incentivizes productive DeFi behavior that deepens liquidity and creates a more robust ecosystem. For users, it’s a chance to be rewarded for strategies they might already be using. For Arbitrum, it’s a powerful investment in its future growth.