Cryptocurrency’s newest shining star has emerged. ASTER price action has been nothing short of meteoric, rocketing a whopping 1,700% over the past week alone. Even following a recent correction of 6% to $1.57, this BNB-based decentralized exchange token has left everyone breathless.

A Look at the Stunning ASTER Price Rally

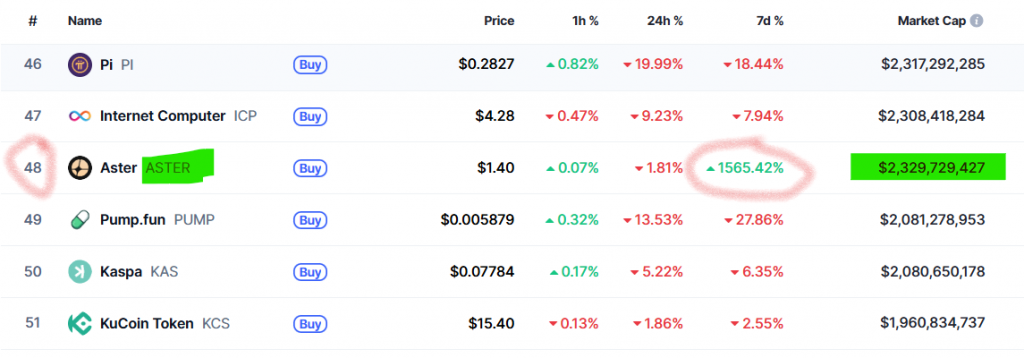

This explosive growth saw ASTER enter the top 50 cryptocurrencies by market cap, at a whopping $2.6 billion today. With such dramatic ascent, there is always a natural reversal to follow. True to form, the price already dipped to $1.30 before reversing upwards by more than 20%, showing much buyer interest yet.

Analyst Outlook: Buy the Dip or Take Profits

So, do investors buy this dip? Popular analyst Altcoin Sherpa shared his strategy, noting he dumped half of his position at about $1.80 but retains most of his position.

He is suggesting that a good dip-buying position can be formed if the price comes back to the $1.13 to $1.25 area. This area could be a main support area. Nevertheless, he cautions that the project can lag behind if confidence will erode. Meanwhile, his tactic is to use a trailing stop-loss and sell bits on the next price bounce with no intention to hold for outlandish long-term prices like $10.

What’s Behind the Aster DEX Mania?

The ASTER price eruption is not happening in a vacuum. The Aster DEX that was launched in March 2025 is gaining traction pretty quickly. It offers spot and perpetual trading on several blockchains like BNB Chain, Ethereum, and Solana.

Above all, it is well-supported by YZi Labs (formerly Binance Labs) and even by Changpeng Zhao, the Binance founder. The native ASTER token is utilized for governance, staking incentives, and fee discounts. Furthermore, its ongoing airdrop, running through October 17, has most likely fueled the hype.

The platform fundamentals are also strengthening. The trading activity has increased to a record high, with revenue from fees this quarter totaling $8.82 million, compared to the $1.8 million last year.