Avalanche Price Breakdown Risk Intensifies at Critical $13 Support

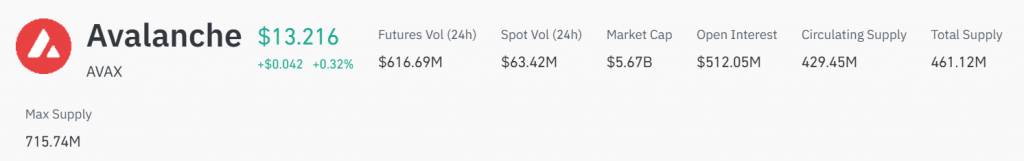

The threat of a significant Avalanche price breakdown is mounting as AVAX struggles to maintain its footing above the crucial $13 support level. Despite encouraging ecosystem growth and a notable spike in trading activity, the token remains trapped within a dominant bearish chart structure, creating a tense standoff between deteriorating technicals and strengthening fundamentals that will determine its near-term trajectory.

Technical Reality: Bearish Structures Remain in Control

The charts present a clear and concerning picture. AVAX is confined within a long-term descending trendline that has capped every major rally since it traded above $30. The recent breakdown from a rising wedge pattern confirmed ongoing bearish momentum, and price is now coiling near $13 in what resembles a descending triangle—a pattern that typically resolves with further downside. The RSI at 42 underscores weak buying interest. A daily close below $13 could trigger the next leg down toward $11.50, with $10 acting as a major psychological floor.

Fundamental Strength: A Growing Disconnect with Price

Paradoxically, this technical weakness exists alongside tangible ecosystem progress. Network activity on the C-Chain is expanding, Total Value Locked (TVL) is trending upward, and the stablecoin supply has surpassed $1.5 billion, indicating real capital inflow. Institutionally, AVAX was added to the Bitwise 10 Crypto Index ETF, and USDC custody support on the C-Chain has improved. This divergence suggests the market is either overlooking these fundamentals or pricing in broader macro headwinds that are overwhelming AVAX’s positive developments.

Market Activity: Rising Volume Hints at a Brewing Resolution

Trading data reveals this tension. Despite minimal price movement, spot volume surged 41% to $301 million, and futures open interest increased, indicating traders are actively opening new positions as AVAX tests these pivotal levels. This rise in activity often precedes a volatile breakout. The question is direction: will fundamentals eventually overpower the chart, or will the technical breakdown prevail?

My Thoughts

This is a classic battle between tape (price action) and story (fundamentals). In the short term, the tape usually wins. The bearish chart patterns are unambiguous, and until AVAX can reclaim the $15.50 – $16 resistance zone on significant volume, the path of least resistance is down. However, the robust fundamental growth creates a compelling long-term value proposition. A washout Avalanche price breakdown toward $10 could create a phenomenal accumulation zone for patient investors betting on the ecosystem’s eventual re-rating. Watch $13 closely—it’s the line in the sand.