In a powerful signal of returning institutional confidence, BlackRock’s Ethereum ETF (ETHA) recorded a massive $314 million net inflow on August 25. This surge comes at a critical time, as prominent analyst Tom Lee predicts that Ethereum is approaching its price bottom, suggesting the worst of the recent sell-off may be over.

A Dramatic Reversal for ETH ETFs

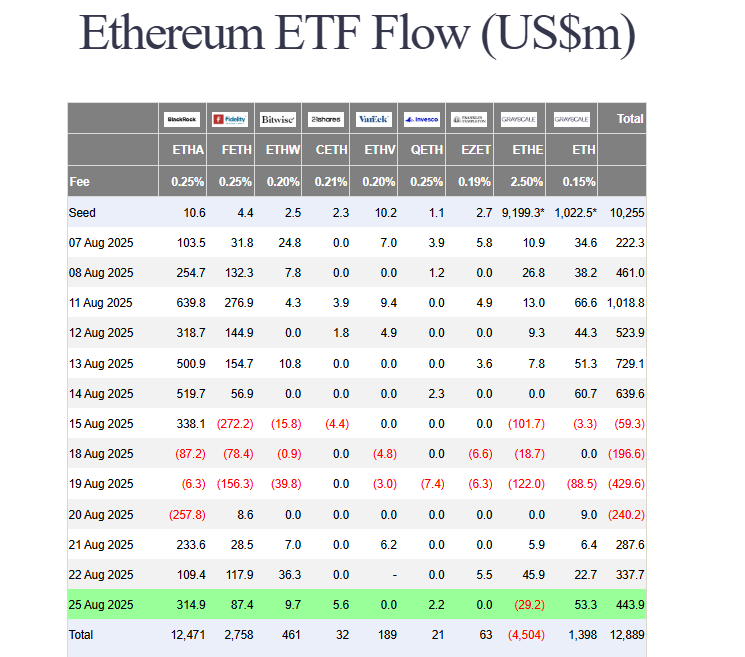

The data from SoSoValue reveals a stunning turnaround. The $314 million inflow—representing 67,899 ETH—followed a brutal period where ETH ETFs collectively bled over $924 million in outflows between August 15-20.

- BlackRock’s Resilience: While others saw steep outflows, IBTC lost only $8.3 million last week before this strong rebound.

- Overall Strength: Cumulative inflows for all ETH ETFs have now topped $12.43 billion, with total net assets at a staggering $30.58 billion.

This single-day inflow helped lift total spot ETF reserves to 6.6 million ETH, meaning these funds now control roughly 5.45% of Ethereum’s entire circulating supply.

Tom Lee: Ethereum is Nearing a Bottom

Amid this renewed institutional interest, Tom Lee, Head of Research at Fundstrat and co-founder of BitMine, offered a highly optimistic forecast. He observed that Ethereum’s price action suggests it is at or very near a floor, with a rebound likely to

follow.

His investment philosophy is to “buy when prices are low,” and his prediction is backed by action. BitMine, his company, has been aggressively accumulating ETH, recently adding 190,000 ETH ($873 million) to its treasury. It now holds a colossal 1.71 million Ethereum, worth $8.8 billion.

The Bottom Line for Investors

The combination of a massive inflow into the world’s largest ETF and a bullish prediction from a respected analyst creates a compelling narrative. It signals that sophisticated institutions are viewing current prices as an attractive entry point.

For investors, this could indicate that the recent period of instability is giving way to a new stabilization phase. If ETF inflows continue to strengthen, they could provide the fundamental support needed to halt the decline and build a foundation for Ethereum’s next leg up.