BNB Price Analysis Reveals Traders De-Risking at Key Support

Our latest BNB price analysis reveals a token under pressure but showing intriguing signals at a critical level. BNB is currently hovering near $830, down roughly 4% on the day. This pullback has triggered a significant jump in trading volume alongside a drop in open interest, a classic sign that traders are closing leveraged positions and reducing risk during the decline. The price is now testing a vital support zone, setting up a decisive technical battleground.

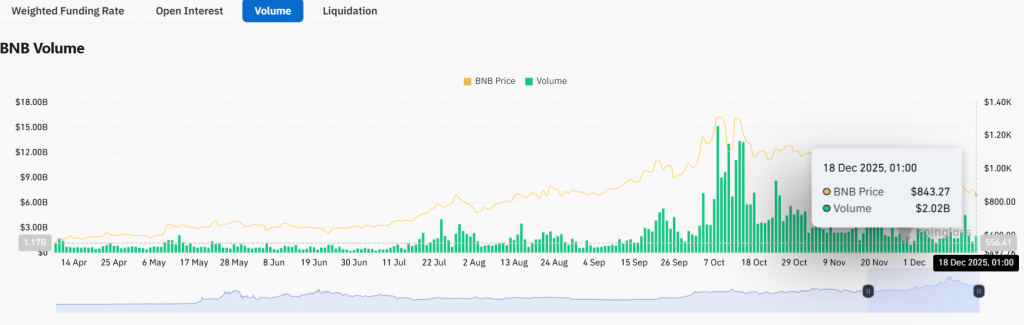

Volume and Derivatives Data Tell the Story

Spot trading volume surged over 33% to $2.02 billion in the last 24 hours, indicating active selling and repositioning. More importantly, derivatives data shows a 48% spike in volume paired with a 1.7% decline in total open interest. This combination typically means traders are exiting positions (both long and short) into volatility rather than aggressively opening new ones. Essentially, leverage is being flushed from the market near support, which can often precede a stabilization.

Strong Fundamentals Counter Price Weakness

Despite the bearish price action, BNB’s foundational strengths are solidifying. Binance recently secured a full suite of licenses from the Abu Dhabi Global Market, a major regulatory milestone. Furthermore, BNB Chain is gaining institutional credibility by hosting BlackRock’s tokenized treasury fund. The network’s auto-burn mechanism continues to reduce supply, and former CEO Changpeng Zhao’s renewed public engagement hints at a strategic refocus. These factors provide a strong counter-narrative to the short-term technical weakness.

Technical Path Forward

Technically, BNB is trading near the lower Bollinger Band around $830. The trend remains bearish, with price stuck below all major moving averages and the RSI languishing below 50. Resistance now sits near $880 (the mid-Bollinger Band) and more firmly at the $900-$920 zone.

The immediate outlook depends on this $830 support. A bounce with conviction above $880 could signal a short-term relief rally. However, a decisive break and close below $820 would likely trigger another leg down as selling pressure resumes.

My Thoughts

This BNB price analysis shows a market in a controlled de-risking phase, not a panic sell-off. The leverage flush at support is a necessary step to build a stronger base. While the technicals are bearish, the robust fundamentals create a compelling divergence. This could present a high-conviction accumulation zone for long-term holders, provided the $820 support holds. The next few daily closes are critical.