Alright, degens and chart watchers – BNB is absolutely pumping! The token just smashed its all-time high, rocketing to an impressive $1,348. This BNB price surge of 32% in a single week makes it the top performer among major cryptos, seemingly fueled by a weaker dollar and a fresh risk-on appetite.

Behind the BNB Price Surge: A Troubling Divergence

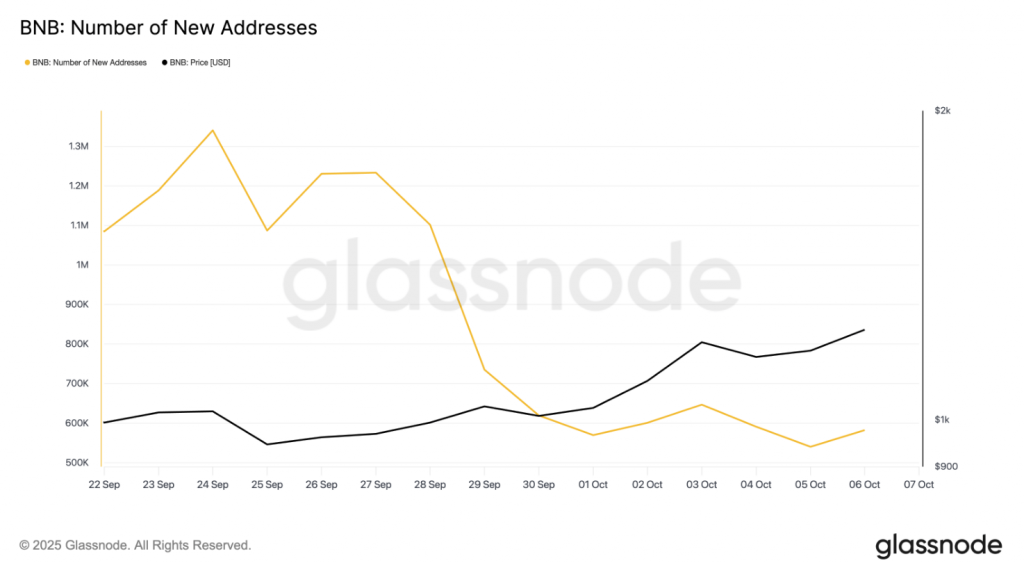

While the price chart looks euphoric, on-chain metrics are painting a dangerously bearish picture. Since late September, the fundamental health of the BNB Chain has been deteriorating. Key data from Glassnode shows that the number of new daily addresses on the network has plummeted by a staggering 57%.

This is a major warning sign. In a healthy bull run, price appreciation is accompanied by growing user adoption. The current divergence means this BNB price surge isn’t being driven by genuine, organic demand for the network itself. Instead, it appears to be a speculative pump that lacks a solid foundation, putting it at a high risk of a sharp reversal.

Overbought and Underpowered: The Perfect Storm for a Correction

The technical analysis confirms the on-chain fears. BNB’s Relative Strength Index (RSI) is currently flashing at a scorching 75.79. For those new to trading, the RSI is a momentum indicator that identifies overbought (above 70) and oversold (below 30) conditions. A reading this high signals that buyers are exhausted and the asset is primed for a cool-down.

With weak network demand and an overbought market, a pullback seems almost inevitable. The key level to watch is $1,100. If that support level breaks, we could see a steeper drop toward $970.

Key Takeaways

- BNB price hit a new ATH of $1,348 amid a broad market rally.

- Critical on-chain data shows a 57% decline in new daily addresses, signaling weak underlying demand.

- #BNB flips XRP In MARKET CAP and it is now the #3 largest crypto coin

- The RSI of 75.79 indicates the token is severely overbought.

- The divergence between price and network health creates a high risk of a near-term correction toward $1,100.

My Thoughts

This is a classic case of “narrative vs. numbers.” The narrative is bullish, but the on-chain numbers are screaming caution. While macro momentum could always push the price higher, this looks like a fragile rally. Smart money is watching these metrics closely. Any shift in market sentiment could trigger a significant correction