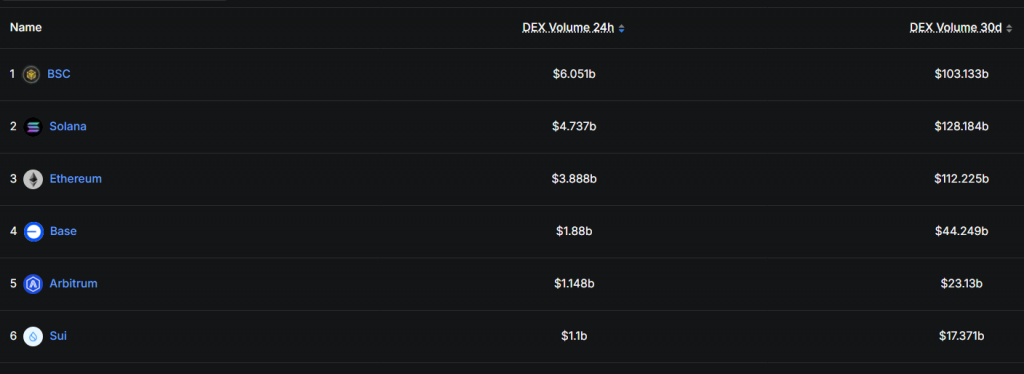

Get ready for some absolutely jaw-dropping numbers from the Binance Smart Chain! BSC DEX volume has just exploded, hitting a staggering $6.05 billion in a single day—marking its highest peak since June 2025. This massive resurgence signals a powerful revival of retail activity, and it’s being almost single-handedly fueled by one thing: a full-blown meme coin season on BNB Chain.

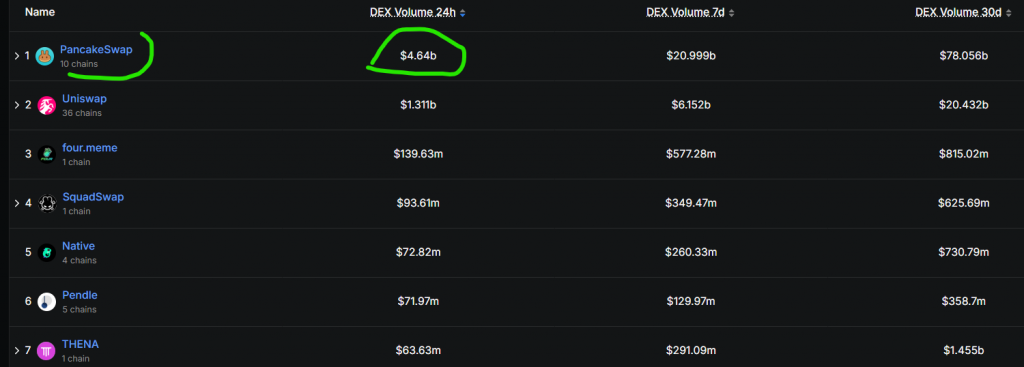

PancakeSwap Leads Unprecedented BSC DEX Volume

The data from DeFi Llama doesn’t lie. The driving force behind this historic BSC DEX volume is none other than the ecosystem’s flagship DEX, PancakeSwap, which accounted for a colossal $4.28 billion of the daily total. Over the past month, PancakeSwap has facilitated over $78 billion in trades.

But the story doesn’t end there. The second and third largest contributors, Uniswap and the meme-centric launchpad Four.meme, added another $1.3 billion and $139 million respectively. This activity pushed the monthly total to an impressive $103 billion, showcasing a vibrant and multi-faceted trading ecosystem.

Meme Coin Mania: 70% of Traders Are in Profit

The catalyst for this volume explosion is a dramatic shift in the meme coin landscape. Even former Binance CEO Changpeng “CZ” Zhao expressed surprise, noting the momentum has swung from Solana back to BSC. On-chain data from BubbleMaps reveals an incredible statistic: roughly 70% of traders buying new BNB-backed meme coins are currently in profit.

The profit distribution is mind-blowing. While the majority of winners saw modest gains around $1,000, the scale of success is immense:

- One whale pocketed over $10 million in profit.

- 44 wallets became millionaires.

- Nearly 900 traders banked $100,000 or more.

In contrast, only about 4,400 traders recorded losses, proving that—for now—the winners are decisively dominating this cycle.

Market Impact

This isn’t just a pump; it’s a fundamental shift. Capital is rotating back into BSC, drawn by the high-profit potential of its nascent meme coin ecosystem. While inherently risky, this frenzy is driving unprecedented usage and fees, directly benefiting the entire BNB Chain. The key is to watch if this volume is sustainable or if it represents a short-term speculative top.