Cardano (ADA) is on a powerful rebound, climbing 13% to reach $0.90—its highest level since August. The surge comes as the crypto market turns its attention to a key regulatory deadline that could catapult ADA even higher: the potential approval of the first Cardano ETF by the U.S. Securities and Exchange Commission (SEC).

Technical Analysis Points to a 20% Rally

The charts are painting a very bullish picture for ADA. On the eight-hour timeframe, the token has completed a falling wedge pattern, a classic technical indicator that often precedes a significant breakout.

- The Pattern: The price has broken above the upper descending trendline of the wedge.

- The Target: By measuring the height of the pattern, analysts project a price target near $1.0640.

- The Move: This represents a potential 21% gain from current levels.

This bullish outlook would be invalidated only if ADA were to crash below the key $0.8300 support level.

The Main Catalyst: The Grayscale ADA ETF Deadline

The primary driver behind this optimism is a looming regulatory decision. The SEC has set October 22 as the deadline to approve or deny Grayscale’s application for a spot Cardano ETF.

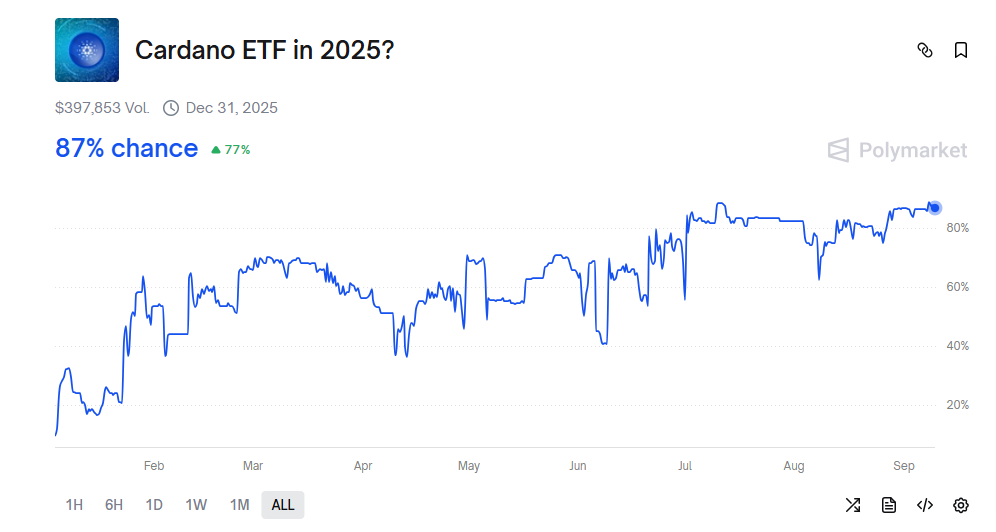

Prediction market Polymarket now assigns an 87% probability that the agency will approve the fund, just shy of its all-time high of 89%. This overwhelming confidence is fueled by Cardano’s profile as a “Made-in-America” project with a strong proof-of-stake utility foundation, similar to Ethereum.

Why an ADA ETF Could Be a Game-Changer

An ETF approval would be monumental for Cardano’s adoption. It would provide a simple, regulated pathway for institutional investors to gain exposure to ADA without directly holding the token.

However, some analysts caution that even if approved, an ADA ETF might not initially attract the same massive inflows as the Bitcoin or Ethereum ETFs did. This could lead to a classic “buy the rumor, sell the news” event where the price pulls back after the approval announcement.

The Bottom Line

Cardano is positioned for a potentially explosive few weeks. The combination of a bullish technical breakout and the high probability of an ETF approval creates a powerful bullish narrative. While a post-approval pullback is possible, the path to $1.06 appears clear for now. For investors, this represents a high-conviction trade setup with a well-defined catalyst on the horizon.