Chainlink Price Outlook: Technical and Fundamental Alignment Points to $20

Our Chainink price outlook has turned decisively bullish as multiple powerful signals converge. LINK is not just stabilizing—it’s forming classic reversal patterns while fundamental data reveals massive institutional accumulation and shrinking available supply. This potent mix suggests a significant breakout toward $20 is now the base case.

Technical Blueprint: A Textbook Bullish Reversal

The daily chart reveals a compelling technical story. LINK has formed two highly reliable bullish patterns simultaneously. First, a clear double-bottom pattern with a neckline at $13.50, and second, a large falling wedge breakout. The token has already surged above the wedge’s upper trendline and is now challenging the Supertrend indicator and the 50-day moving average. This technical alignment is a classic setup for continuation, with the next major resistance target at $20, representing a 45% surge from current levels. The invalidation point remains the double-bottom low at $11.56.

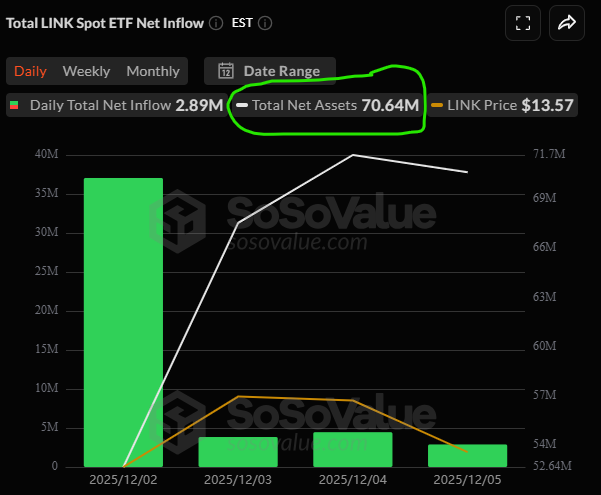

Fundamental Fuel: ETF Inflows and Shrinking Supply

The technical breakout is backed by remarkable fundamental strength. Since its launch, the U.S. spot LINK ETF has seen inflows every single day, amassing over $48 million and bringing total assets to $70.6 million. Even more telling is the drastic drop in available sell-side pressure. The supply of LINK on exchanges has plummeted from 264 million tokens in November to just 218 million today—a clear sign of strong hands moving tokens into long-term storage. This supply shock is occurring as whales aggressively accumulate, doubling their holdings since November.

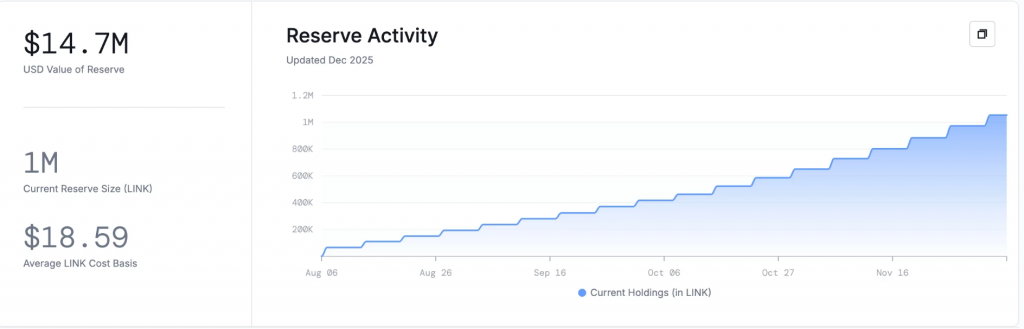

Strategic Reserves and the Path Forward

Adding to the demand thesis, the Chainlink team itself is a major buyer through its Strategic LINK Reserves. This treasury has grown to 1 million LINK ($14.7M), funded directly from network fees. This creates a virtuous cycle of organic, protocol-driven demand. With ETF adoption still in its early days (0.75% of market cap vs. 5%+ for BTC/ETH), the runway for further institutional inflows is substantial.

My Thoughts

This is a near-perfect bullish convergence. The technicals provide the roadmap, while the fundamentals (ETF inflows, supply drop, whale accumulation) provide the fuel. The decrease in exchange supply is particularly critical—it means every new dollar of demand will have a greater price impact. The Chainlink price outlook is the most constructive it’s been in months. If the broader market finds stability, LINK has all the ingredients to lead the next altcoin rally, with the $20 target acting as a magnet.