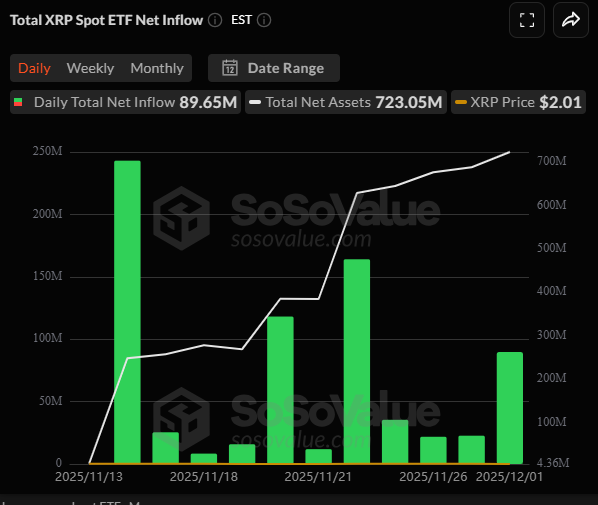

ETF Institutional Rotation Revealed: XRP Draws $90M as Solana Sees Record Outflow

A dramatic shift in institutional preference is playing out in real-time. While the spot Bitcoin and Ethereum ETF complex bleeds, a clear ETF institutional rotation is channeling capital toward select altcoins. The data is striking: U.S. spot XRP ETFs hauled in another $90 million in net inflows on December 2, their fourth-largest haul ever. Meanwhile, spot Solana ETFs recorded their largest single-day outflow of $13.55 million, led by heavy redemptions from the 21Shares fund. This divergence reveals how smart money is moving within the crypto sector, pivoting toward assets with perceived asymmetric upside.

Dissecting the Solana ETF Outflow and Price Resilience

The record Solana ETF outflow, primarily a $32.54 million redemption from 21Shares’ TSOL, breaks a weeks-long streak of robust inflows. However, context is crucial. Despite this single-day pullback, total assets under management (AUM) for Solana ETFs remain robust at over $790 million. Furthermore, leaders like Bitwise’s BSOL and Grayscale’s fund continued to see inflows, suggesting this is a reallocation, not a sector-wide exodus. Defying the outflow news, SOL price actually rebounded 3% to trade around $127.53, demonstrating that spot market buyers are stepping in to absorb any ETF-related selling pressure.

XRP’s Quiet Accumiation and Bullish Technicals

In stark contrast, XRP ETFs are experiencing relentless accumulation. The $90 million inflow was led by Grayscale’s GXRP ($52.30M) and Franklin Templeton’s XRPZ ($28.41M). This persistent demand is occurring alongside a major on-chain transition: Santiment data shows whales holding over 100 million XRP are at a 7-year high, controlling a staggering 48 billion tokens. This signals a transfer from weak to strong hands. Technically, the TD Sequential indicator has flashed a buy signal on the weekly chart, and veteran trader Peter Brandt has forecasted a coming rally. Despite trading sideways around $2.01, the setup is increasingly bullish.

My Thoughts

This isn’t bearish for Solana; it’s a healthy rebalancing after a parabolic inflow streak. The ETF institutional rotation into XRP is far more significant—it shows institutions are building long-term positions during price consolidation. When combined with the whale accumulation and bullish technicals, XRP is constructing a powerful launchpad. For SOL, the maintained AUM proves the institutional thesis is intact. This rotation creates alpha opportunities: XRP for accumulation before a breakout, SOL for a bounce after this localized flush.