Ethereum is bleeding red on the charts, but the smartest money in the room is quietly loading up. Despite ETH crashing below the critical $2,000 psychological level, Ethereum accumulation addresses have absorbed a staggering 1.3 million ETH—worth roughly $2.6 billion—in just five days. This isn’t panic; this is strategic positioning by investors playing the long game.

Decoding the Massive Ethereum Accumulation Signal

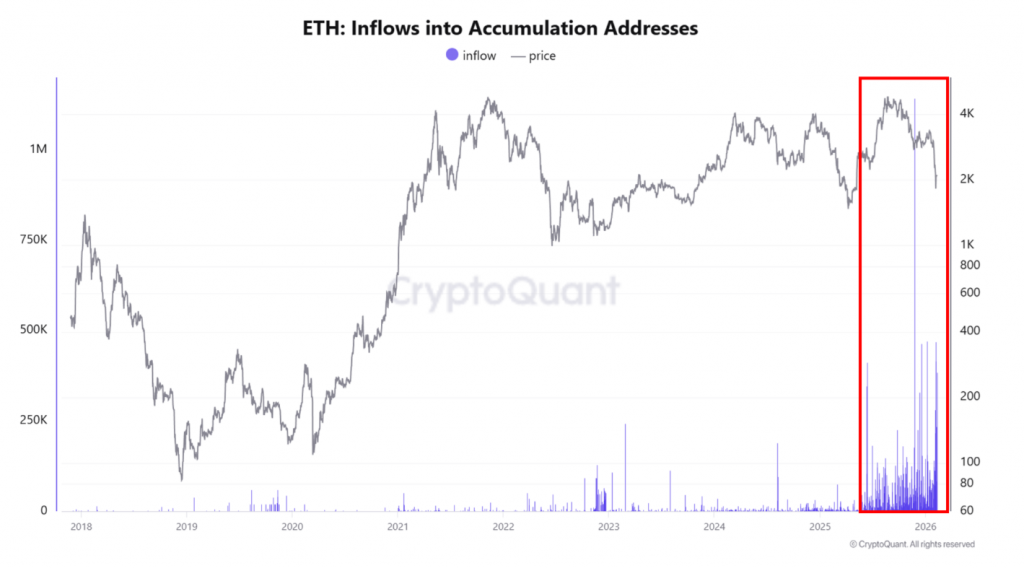

Accumulation addresses are wallets that only receive, never send. They represent the ultimate diamond hands: long-term holders, institutions, and whales who stack and forget. Data from CryptoQuant reveals these addresses have been on a “full-scale accumulation” tear since June 2025, and the pace is accelerating. Total ETH held by these addresses has hit a record 27 million coins, up 20% in 2026—even as ETH price cratered 34.5% over the same period.

This is a historically powerful signal. Past spikes in accumulation inflows have preceded major rallies, including an 85% price surge following June 2025’s peak inflow day.

The Pain is Real: 58% of Addresses Underwater

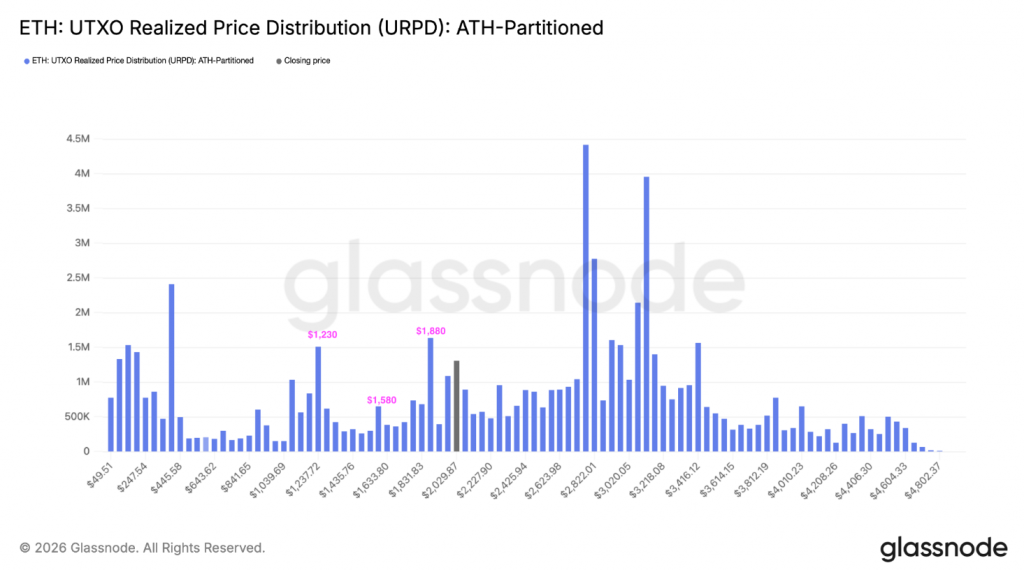

Let’s be clear: this is a brutal market. With ETH at $1,954, over 58% of all Ethereum addresses are in the red. Long-term holders are sitting on unrealized losses, with the average accumulation address cost basis sitting at $2,580. Even ETF investors are hurting, with the average cost basis near $3,500.

Notable casualties include BitMine, the world’s largest Ethereum treasury, now facing over $8 billion in paper losses. The mood is fearful, and price action is fragile.

Key ETH Levels to Watch Below $2,000

If bulls cannot reclaim $2,000 quickly, analysts warn of a cascade lower. Immediate support sits at $1,800-$1,850. A breakdown could accelerate toward $1,500, with extreme downside scenarios targeting the $750-$1,000 zone—a level some analysts argue is inevitable based on historical monthly candle structures.

However, the UTXO realized price distribution (URPD) shows thicker support clusters at $1,880, $1,580, and $1,230, suggesting potential bounce zones.

My Thoughts

This is the clearest divergence I’ve seen this cycle. Ethereum accumulation is screaming bullish while price action screams bearish. One of these narratives is wrong. History says follow the whales, not the panic. These accumulation spikes don’t happen at tops; they happen at generational bottoms. While the macro environment remains challenging, the on-chain behavior suggests that the smartest capital is treating sub-$2,000 ETH as a gift. I’m not calling an immediate reversal, but I am saying this: the foundation for the next bull run is being laid right now, quietly, while everyone is looking the other way.