Ethereum is presenting a fascinating paradox. While the ETH price dropped 4.63% to $4,303 to start the weekend, underlying network demand is hitting explosive, record-breaking levels. This divergence between short-term price action and powerful fundamental metrics suggests this dip may be a temporary pause in a much larger bullish trend.

Short-Term Dip vs. Long-Term Gains

The price decline was driven by a wave of selling pressure during morning trading sessions, pushing ETH down toward $4,280. However, it’s crucial to view this in the context of Ethereum’s incredible longer-term performance:

- Monthly Gain: +13%

- 6-Month Gain: +94%

- Yearly Gain: +70%

- 5-Year Gain: +980%

This short-term pullback looks minor compared to the monumental gains ETH has delivered to investors.

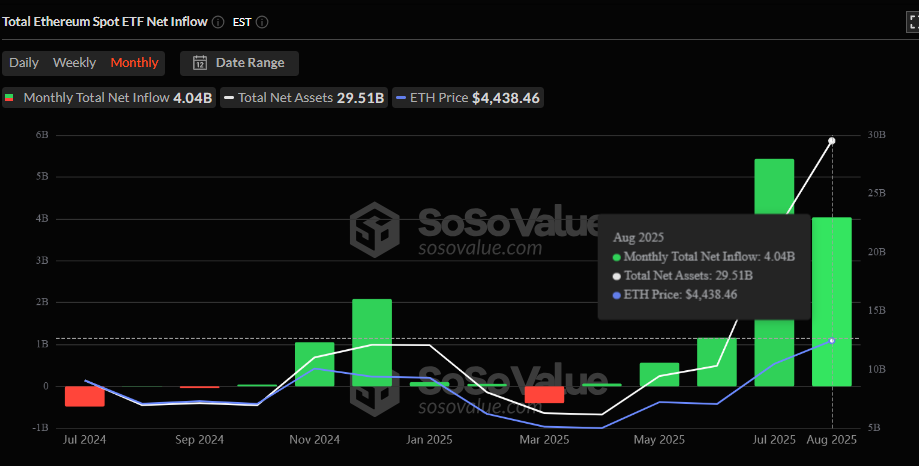

The $4 Billion Institutional Stamp of Approval

The most bullish signal isn’t on the price chart—it’s in the ETF flow data. August was a historic month for institutional demand.

- Monthly Inflows: $4 billion into spot Ethereum ETFs.

- Total Net Assets: $29.51 billion.

- BlackRock’s Lead: Its iShares Ethereum Trust (ETHA) alone attracted over $300 million in August.

This represents a massive acceleration from the first half of 2025, where monthly inflows typically hovered between $1-2 billion. Institutions aren’t just dipping their toes in; they’re diving in headfirst.

On-Chain Activity Explodes to Record Highs

While institutions buy ETFs, users are flooding the Ethereum network. Key on-chain metrics for August shattered records:

- DEX Volume: $135 billion (Up from $87B in July)

- Transactions Processed: 48 million

- Active Addresses: 15 million

- Total Value Locked (TVL): $240 billion

This surge in real, organic usage proves that Ethereum’s value proposition is stronger than ever. The network is the undisputed heart of the DeFi economy, and activity is booming.

The Bottom Line

For savvy investors, this dip represents a potential opportunity. The combination of record institutional inflows and exploding on-chain usage creates a incredibly bullish fundamental backdrop. Short-term price volatility is normal, but the long-term trajectory for Ethereum, powered by both Wall Street and Main Street, points decisively upward.