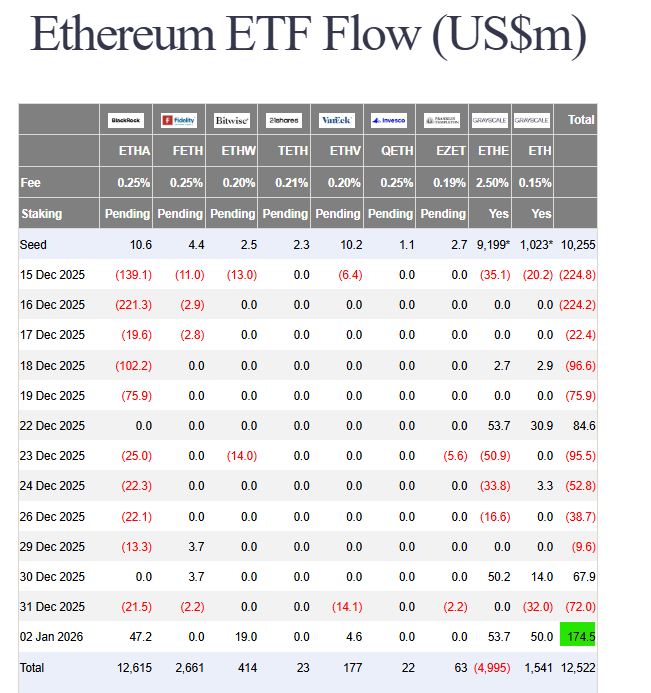

Bullish Reversal: Ethereum ETF Inflows Surge to $174 Million

Institutional money is flooding back with force! After weeks of relentless outflows, U.S. spot Ethereum ETF inflows exploded with a massive $174.43 million net positive day on January 2. This powerful reversal breaks a concerning three-week redemption streak and signals a major shift in institutional sentiment as traders return from the holidays.

Ethereum ETF inflows Source : Farside InvestorsLeading the charge was Grayscale, with its ETHE product pulling in $53.69 million. Meanwhile, BlackRock’s iShares Ethereum Trust (ETHA) attracted a strong $47.16 million. This broad-based buying across multiple issuers pushed total Assets Under Management (AUM) up by over $1 billion in a single day, now standing at $19.05 billion. The cumulative net inflow for all Ethereum ETFs has now climbed to a staggering $12.50 billion.

Ethereum Weekly ETF inflows Source : SoSoValueA Tandem Rally: Bitcoin ETFs Show Matching Strength

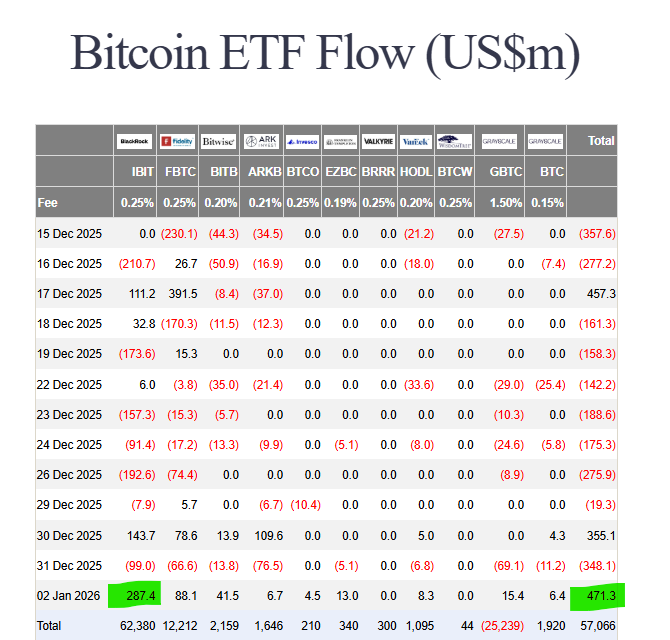

Notably, this resurgence isn’t isolated. Bitcoin spot ETFs mirrored the bullish action perfectly, scooping up $471.14 million in net inflows on the same day. BlackRock’s IBIT fund led that charge with roughly $287 million. This tandem strength between the two largest crypto assets highlights a renewed, market-wide institutional risk-on appetite.

The data shows a clear narrative: the year-end tax-selling and profit-taking pressure has definitively ended. Trading volume skyrocketed, with total Ethereum ETF trade value hitting $2.26 billion versus just $808 million days before. This surge in volume and inflow is a classic indicator of fresh capital entering the market, setting a bullish tone for January.

My Thoughts

This is the institutional vote of confidence we needed to see. The synchronized inflows into both BTC and ETH ETFs tell us that smart money isn’t picking favorites—it’s rebuilding exposure to the entire crypto blue-chip sector. The reversal is too large and coordinated to be random. It likely marks the beginning of a new quarterly allocation cycle. For traders, this strongly suggests the late-2025 downtrend has exhausted itself, and the path of least resistance is now up.