Ethereum ETF Inflows Ignite as Institutional Demand Returns with $96M Surge

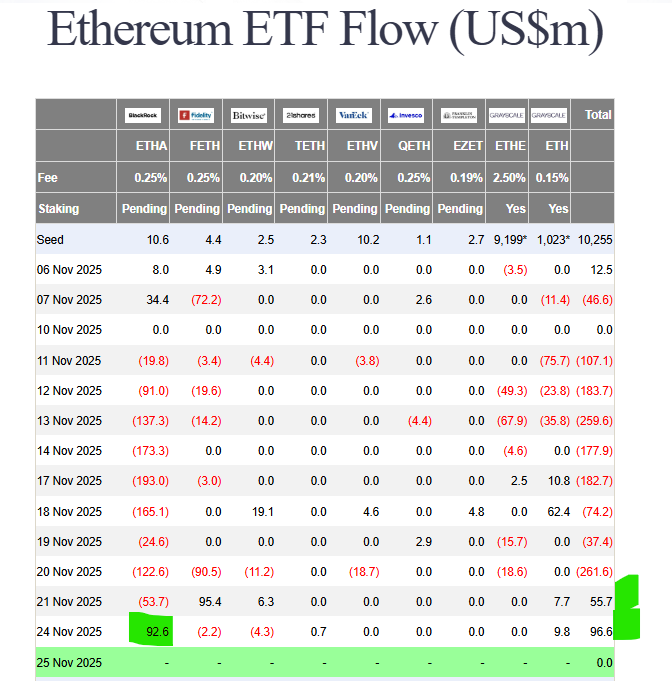

Ethereum is displaying remarkable strength, holding firmly above $2,900 after a 2% gain. This resilience is fueled by a powerful resurgence in institutional demand, with U.S. spot Ethereum ETF inflows exploding to $96.6 million on November 24. The real story? BlackRock’s IBIT ETF accounted for a massive $92.6 million of that total, marking its first inflow after two weeks of outflows. This signals that the smart money is confidently returning to ETH, creating a solid foundation for the next leg up.

Behind the Massive Ethereum ETF Inflows

This wave of Ethereum ETF inflows isn’t just about BlackRock. It reflects a broader institutional shift. While Bitcoin ETFs have struggled with outflows, Ethereum is suddenly attracting capital, highlighting its relative strength. The demand is further confirmed by on-chain activity. Crypto giant BitMine accumulated a staggering 69,822 ETH (worth over $200 million) last week, boosting its total holdings to 3.63 million ETH—a full 3% of the entire supply. This level of accumulation from both ETFs and large treasuries is creating a significant supply squeeze on exchanges.

Technical Setup Suggests a Slow-Burn Bull Run

Analysts are noting that Ethereum appears to be in a “slow bull mode,” characterized by gradual, sustained upward momentum rather than explosive pumps. The weekly chart shows patterns reminiscent of past bullish cycles, with higher lows indicating underlying strength. Technically, the MACD indicator has flipped to positive, with its line crossing above the signal line—a classic buy signal. The RSI is hovering around a neutral 50, providing ample room for upward movement before becoming overbought. The key level to watch is $3,000; a decisive break above it could trigger a rush toward $3,300.

My Thoughts

This is the institutional validation Ethereum needed. The return of Ethereum ETF inflows, combined with massive treasury accumulation, proves that major players see current prices as a strategic entry point. The “slow bull” thesis is actually ideal—it allows for a healthier, more sustainable rally without the frenzy of leverage. I believe ETH is coiling for a significant move, and the convergence of fundamental and technical factors suggests the path of least resistance is up.