The institutional exodus from Ethereum shows no signs of slowing. Spot Ethereum ETFs have recorded four consecutive weeks of net outflows, with on-chain data suggesting a fifth straight week of redemptions is imminent. This sustained selling pressure has coincided with a brutal price correction, leaving ETH struggling to hold the psychologically critical $2,000 level.

Four Weeks of Ethereum ETF Outflows: The Data

According to SoSoValue historical data, the outflow streak began in late January and has accelerated through February. While precise weekly totals vary, the trend is unmistakable: institutions are reducing exposure at the fastest pace since ETH ETFs launched.

The selling mirrors broader market dynamics. Bitcoin ETFs have also bled assets during this period, confirming a risk-off posture across digital asset classes. Total crypto market capitalization has contracted accordingly.

Price Action and Sentiment Hit Rock Bottom

Ethereum currently trades near $2,000, down significantly from January highs. Technicals are bearish: price sits below both short and long-term moving averages, with the 20-day EMA now acting as resistance. Market observers warn that a decisive break below $1,900 could accelerate losses toward $1,800.

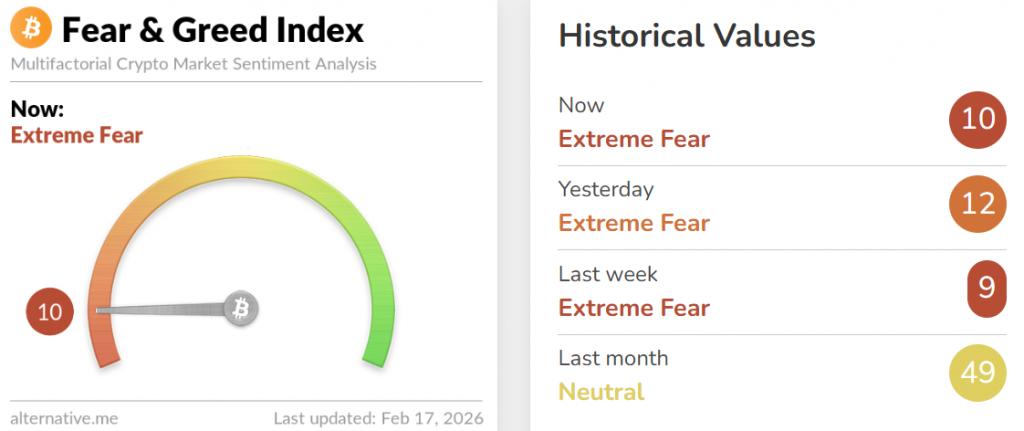

The Crypto Fear & Greed Index has plunged into “Extreme Fear” territory—a reading that historically precedes either capitulation bottoms or further despair. Daily trading volumes have dried up, reflecting dwindling participation.

My Thoughts Ethereum ETF outflows at this scale are undeniably bearish in the short term. Institutions are de-risking, not rotating. But here’s the nuance: extreme fear is a contrarian signal. The last time sentiment hit these depths, ETH was trading below $1,500—right before a 100% rally.

The $2,000 level is now a psychological battleground. If it holds, we could see a relief bounce as short sellers take profits. If it breaks, expect a rapid flush to $1,800, where historical demand sits.

For long-term investors, this is the accumulation zone. Not because the pain is over, but because capitulation creates opportunity. Institutions sell; smart money builds positions. The question is whether you have the conviction to buy when everyone else is fleeing.