The Exodus Continues: Ethereum ETF Outflows Reach 7 Straight Days

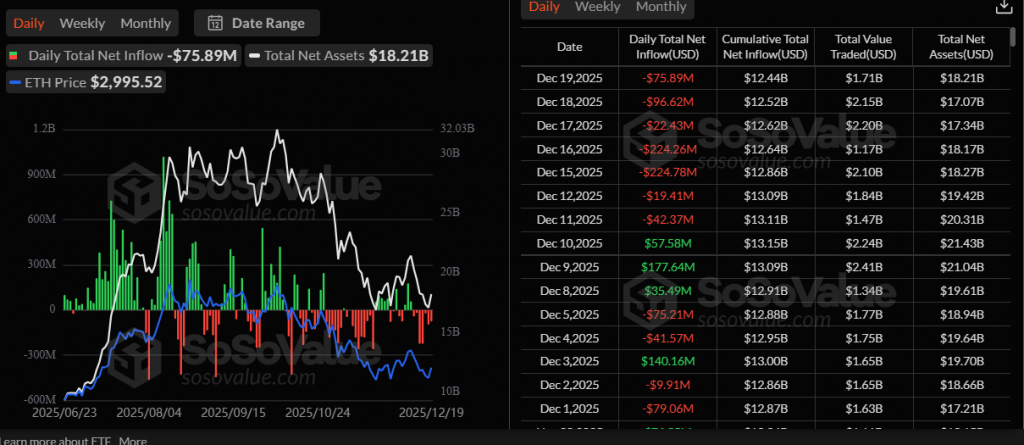

The institutional chill on Ethereum is getting colder. Spot Ethereum ETFs have now suffered net outflows for seven consecutive trading days, with another $75.89 million exiting on December 19th. This relentless Ethereum ETF outflows streak, driven entirely by BlackRock’s ETHA fund, has drained over $685 million from the products in just over a week. With ETH struggling below $3,000, the data paints a clear picture of institutional risk-off sentiment in the short term.

BlackRock’s ETHA: The Sole Source of the Bleed

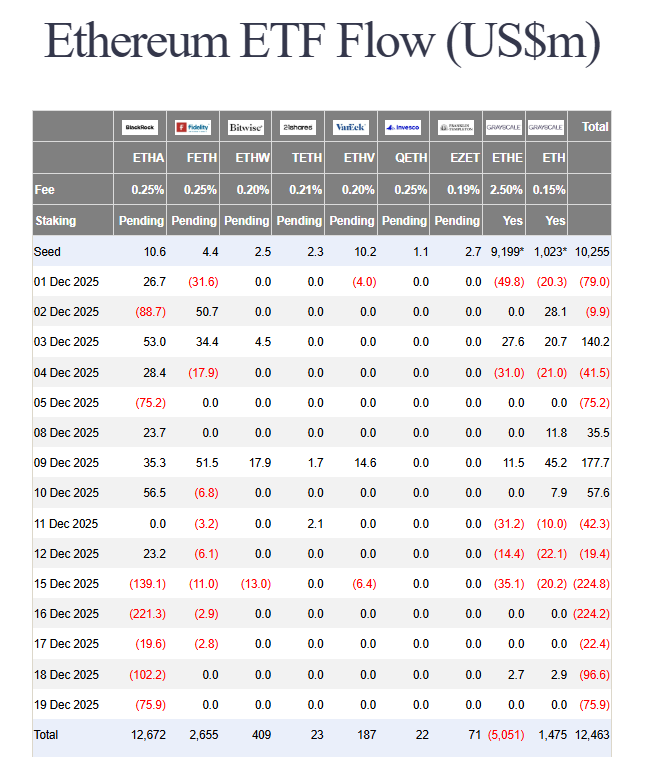

A striking detail emerges from the flow data. On December 19th, BlackRock’s iShares Ethereum Trust (ETHA) was the only fund to see activity, accounting for 100% of the day’s $75.89 million outflow. The other eight ETFs, including offerings from Fidelity, Grayscale, and Bitwise, recorded precisely zero flows.

This highlights a concentrated pullback from one of the largest and most influential issuers. While ETHA still holds a dominant $12.67 billion in cumulative inflows, the persistent selling from this giant is a significant weight on sentiment. The outflow streak began modestly in mid-December before accelerating sharply, with two days last week each seeing outflows exceed $224 million.

Context and Cumulative Impact

The total net assets under management (AUM) for Ethereum ETFs have fallen to $18.21 billion. Cumulative net inflows have dropped from $13.15 billion to $12.44 billion since the last positive flow day on December 10th.

It’s important to frame this within the broader market. This trend mirrors the caution seen in Bitcoin ETFs and aligns with a period of general crypto market weakness and macro uncertainty. The outflows represent a tactical reduction in exposure, not a total abandonment, as the foundational AUM remains substantial.

My Thoughts

This is a clear signal of institutional pause. The Ethereum ETF outflows are more pronounced than Bitcoin’s, suggesting traders may be rotating out of the perceived “riskier” beta play (ETH) during uncertainty. While concerning in the near term, this doesn’t erase the structural breakthrough of having these ETFs listed. It does, however, indicate that the path to a price recovery likely requires a shift in macro sentiment first. Once ETF flows stabilize and turn positive, it will be a powerful confirming signal for the next leg up.