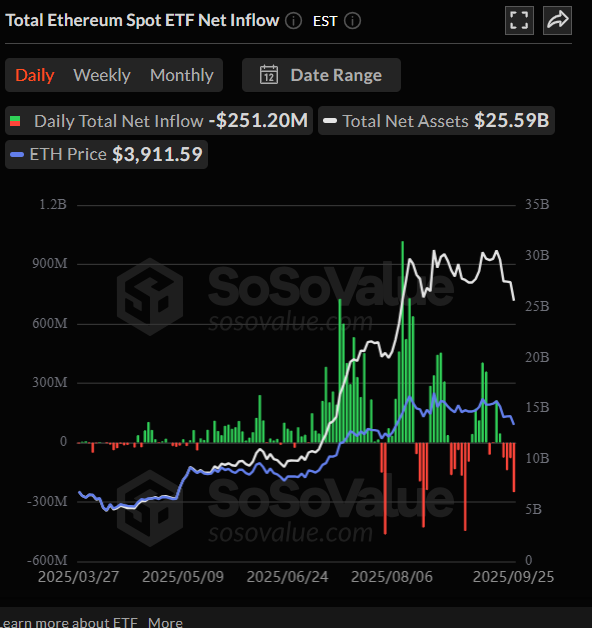

Ethereum’s situation is getting desparate. Institutional investors are rushing for the door in a mass exodus, and spot Ethereum ETFs have seen a disastrous $251.20 million withdrawn on September 25th. It is the fourth consecutive day of drawdowns, bringing the week’s total to a spine-tingling $547 million and hammering the ETH price into sub-$4,000.

A Summary of the Ethereum ETFs downtrend

The exodus was led by Fidelity’s FETH fund, which had a whopping $158 million outflow. Grayscale’s ETHE and Bitwise’s ETHW weren’t far behind with their respective large-sized outflows. This relentless selling pressure reflects a precipitous loss of confidence from the top institutional players.

In relative strength terms, as compared to Bitcoin ETFs on a weekly basis, Ethereum products are clearly faring worst under the bearish sentiment.

ETH Price Crash: Levels to Note

The massive Ethereum ETFs outflows have squarely driven a price crash. ETH now trades dangerously at $3,939, down 13% on the week. The crash has taken it dangerously near the next key support zone between $3,750 to $3,800.

Nightmare Scenario: With continuation selling and ETH breaking below $3,900, a swift fall towards the $3,750 support is highly likely.

Recovery Hope: For any hope of a recovery, bulls must maintain the current level and push the price above $4,100 to indicate the possibility of reversal.

The Verdict: A Market in Crisis

The ongoing Ethereum ETFs outflows establish a desperate market. Technicals are weakened momentum with no visible bullish catalyst in sight, and the near-term outlook is bleak. The path of least resistance is lower, and the $3,800 support level is now the final bastion against a more precipitous drop.