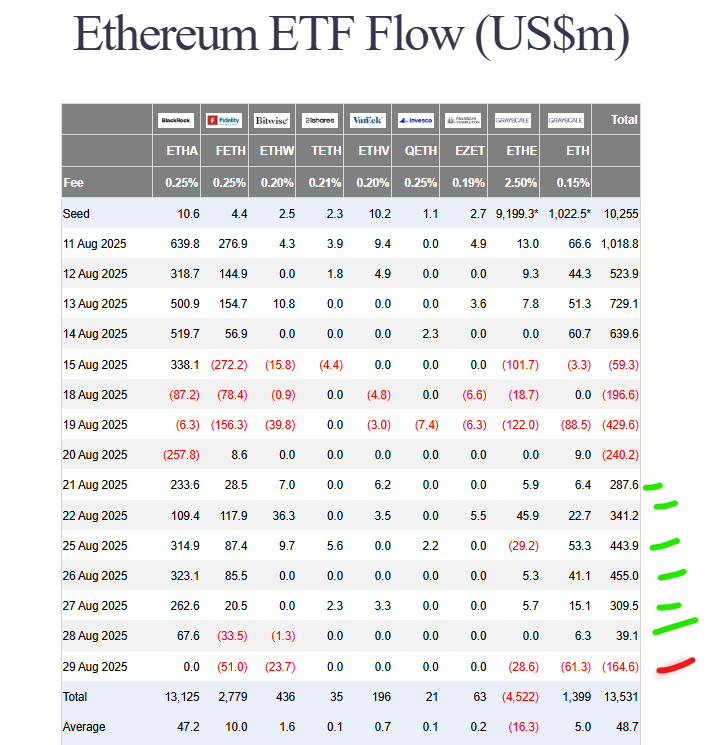

After a strong run, Ethereum ETFs finally saw a wave of profit-taking. On August 29, the funds recorded $164.64 million in daily net outflows, snapping a six-day streak of consecutive inflows that had brought in nearly $1.9 billion. Despite the single day of withdrawals, August remained a massively successful month, with total net inflows reaching $3.87 billion.

Breaking Down the Outflows

The outflows were widespread across several major issuers, mirroring a similar trend in Bitcoin ETFs which saw $126 million exit on the same day.

- Grayscale: Its ETH and ETHE funds led the outflows with $61.30 million and $28.64 million, respectively.

- Fidelity: Saw outflows of $51.02 million.

- Bitwise: Recorded $23.68 million in outflows.

- BlackRock: Notably, its iShares Ethereum Trust (ETHA) saw zero net flows, showing relative stability.

This pullback is likely a natural reaction to Ethereum’s recent rally to a new all-time high of $4,953 on August 24. After a 73% gain in 90 days, some investors decided to lock in profits.

The Bigger Picture: Institutional Demand Remains Strong

It’s crucial to view one day of outflows in context. The $3.87 billion in net inflows for August, while lower than July’s record $5.5 billion, still represents enormous institutional demand.

This strength is reflected beyond ETFs. Data from Strategic ETH Reserve shows that ETH treasury companies now hold 4.44 million ETH ($19.34 billion), accounting for 3.67% of the total supply. These companies are now accumulating ETH at a faster rate than Bitcoin treasury companies are buying BTC.

A Bitcoin Whale Is Betting Big on ETH, Too

Adding to the institutional narrative, a legendary Bitcoin whale is making a huge bet on Ethereum. On-chain analytics firm Lookonchain reported that the whale deposited another 2,000 BTC ($217 million) into Hyperliquid and sold it to buy more spot ETH.

This is part of a larger move. The entity has now purchased a staggering 691,358 ETH ($3 billion), shifting a significant portion of its portfolio from Bitcoin to Ethereum in anticipation of a potential altcoin season.

The Bottom Line

While a single day of outflows might spark concern, the overall trend for Ethereum remains powerfully bullish. Strong monthly inflows, aggressive accumulation by corporate treasuries, and a major Bitcoin whale rotating into ETH all signal deep institutional conviction. With a potential Fed rate cut in September, the fundamental case for Ethereum continues to strengthen, suggesting this outflow is likely a temporary pause in a longer-term uptrend.